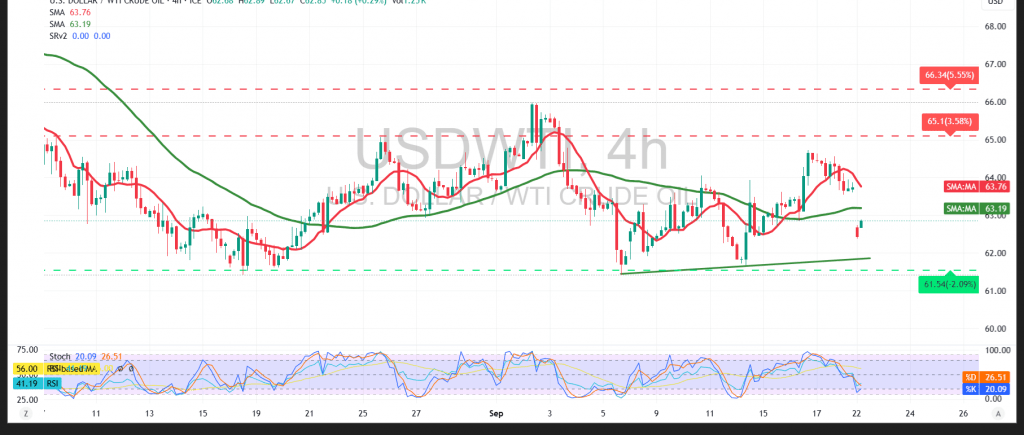

US crude oil futures opened with a bearish gap, touching a low of $62.44 per barrel during early trading.

Technical Outlook:

- Simple Moving Averages (SMA): Pressuring the price from above, acting as dynamic resistance that may hinder recovery attempts.

- Relative Strength Index (RSI): Stabilizing below the 50 level, confirming the persistence of negative momentum.

- Key Resistance: $63.25 remains the pivotal barrier to any rebound attempts.

Probable Scenario:

As long as trading remains below $63.25, the downside bias is favored. A break of $62.15 would intensify selling pressure and pave the way toward $61.30 as an intraday target.

Conversely, a confirmed breakout above $63.25 on an hourly close could spark a temporary recovery attempt, with gains extending toward $63.80.

Alert: Gap covering remains in effect.

Warning: Risk is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 62.15 | R1: 63.80 |

| S2: 61.45 | R2: 64.80 |

| S3: 60.45 | R3: 65.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations