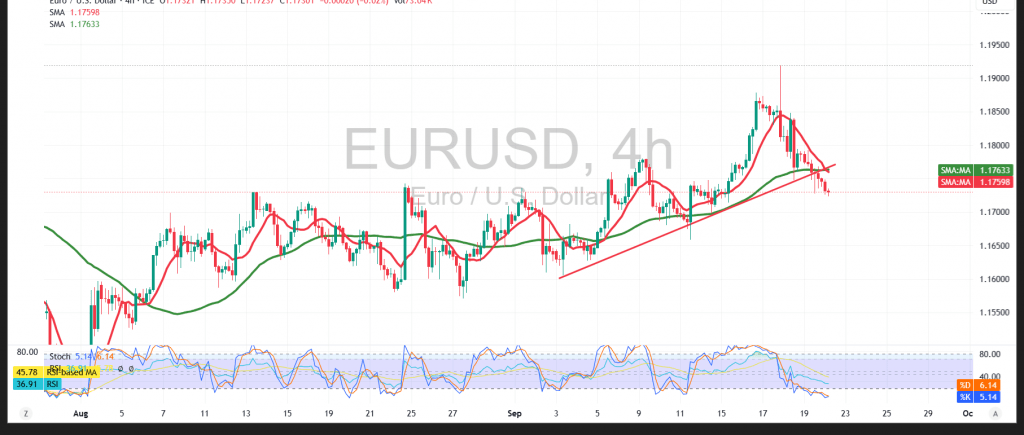

The pair reversed from the 1.1800 psychological resistance, recording 1.1792, with bearish momentum returning to dominate intraday movements.

Technical Outlook:

The negative crossover of the simple moving averages continues to act as dynamic resistance, weighing on price action. Although the Relative Strength Index (RSI) briefly cleared the oversold zone, it has started sending fresh negative signals, reinforcing the likelihood of extended selling pressure. A potential break of the intraday ascending trend line could accelerate declines.

Probable Scenario:

As long as trading remains below 1.1770, the bearish trend is likely to persist. A confirmed break of 1.1725 may open the path for further losses toward 1.1700 and then 1.1680. Conversely, a recovery above 1.1770 could trigger a short-lived rebound with 1.1820 as the next target.

Warning: Risks are high amid ongoing trade tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1700 | R1: 1.1770 |

| S2: 1.1680 | R2: 1.1815 |

| S3: 1.1640 | R3: 1.1845 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations