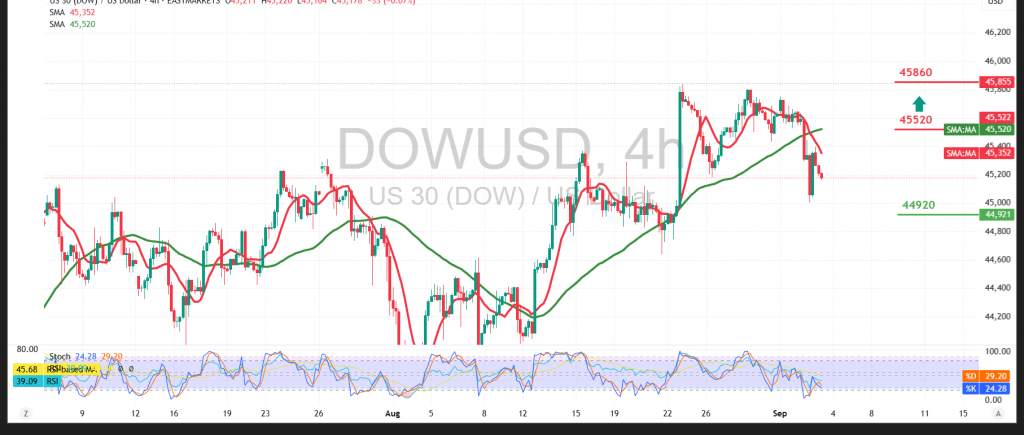

The Dow Jones Industrial Average (DJI30) turned bearish after facing strong resistance near 45,606, which triggered downside pressure and some negative trades.

Technical Outlook – 4-hour timeframe:

The 50-period simple moving average is weighing on the price from above, acting as resistance and potentially limiting any recovery attempts. The Relative Strength Index (RSI) is also signaling weakness, adding to the bearish tone.

Probable Scenario:

A confirmed hourly close below 45,160 would likely increase selling pressure and push the index toward retesting the next support levels shown on the chart. Conversely, if the price consolidates above the 45,520 resistance level, bullish momentum could return, paving the way for a retest of higher resistance areas.

Fundamental Note:

Today’s session will feature high-impact US economic releases, including job openings and labor turnover (JOLTS), which could trigger sharp market volatility.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 44920 | R1: 45520 |

| S2: 44660 | R2: 45865 |

| S3: 44320 | R3: 46125 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations