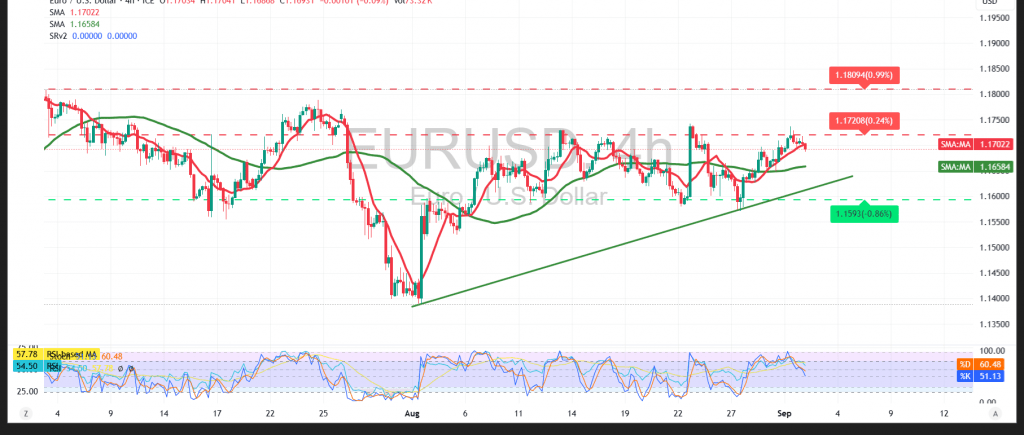

The EUR/USD pair started the week’s trading with a bullish bias, climbing to 1.1736 after breaking through the psychological resistance at 1.1700.

Technical Outlook – 4-hour timeframe:

Despite minor intraday pullbacks, the 50-period simple moving average continues to support the upward trend. The Relative Strength Index (RSI) is showing signs of potential positive divergence after moving into oversold territory, which could bolster bullish momentum. In addition, the pair is trading along an ascending trend line, further reinforcing the positive outlook.

Probable Technical Scenario:

The current setup strengthens the bullish case, and a confirmed break above 1.1730 could act as a catalyst for extended gains.

Conversely:

An hourly close below 1.1675 could trigger a short-term reversal, exposing the pair to a retest of support near 1.1640.

Fundamental Note:

Today’s session features high-impact US economic data, specifically the ISM Manufacturing PMI, which could generate heightened price volatility upon release.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1675 | R1: 1.1730 |

| S2: 1.1650 | R2: 1.1760 |

| S3: 1.1610 | R3: 1.1800 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations