The USD/CAD pair declined in the previous trading session. As highlighted in our last report, we maintained a neutral stance due to conflicting technical signals, noting that a break below 1.3820 would apply negative pressure and open the way for a retest of 1.3790. The pair indeed extended losses, reaching a low of 1.3769.

Technical Outlook – 4-hour timeframe:

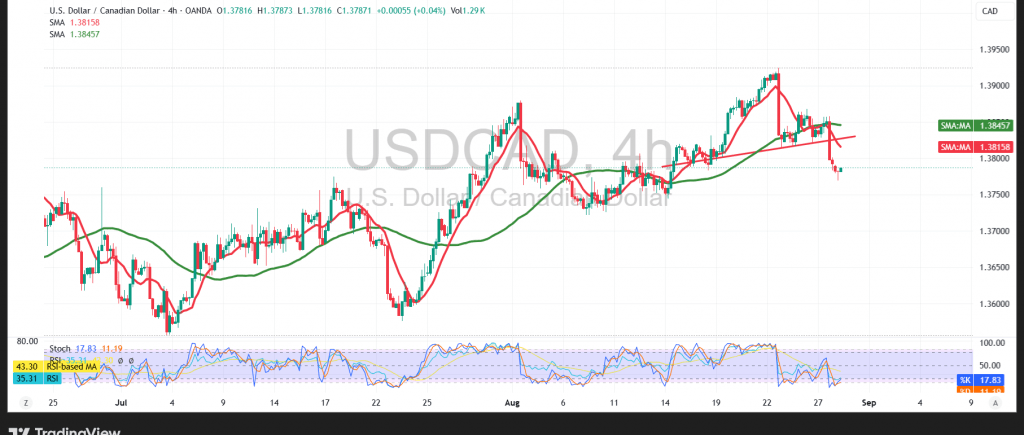

The pair has confirmed a break below the ascending support line, as illustrated on the chart. This breakdown, combined with the continued negative crossover of the simple moving averages, strengthens the case for a continuation of the broader bearish trend.

Probable Scenario:

As long as trading remains below the previously broken support—now turned resistance under the role-reversal principle—at 1.3840, the downside outlook remains dominant. Bearish targets are located at 1.3750 initially, with a further extension toward 1.3670. Conversely, a successful break above 1.3840 would invalidate the bearish scenario and restore upward momentum, with potential targets at 1.3900.

Fundamental Note:

Traders are awaiting high-impact US economic data today, including the preliminary GDP (quarterly) reading and weekly unemployment claims. These releases may trigger heightened volatility across USD pairs.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3750 | R1: 1.3840 |

| S2: 1.3715 | R2: 1.3900 |

| S3: 1.3665 | R3: 1.3935 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations