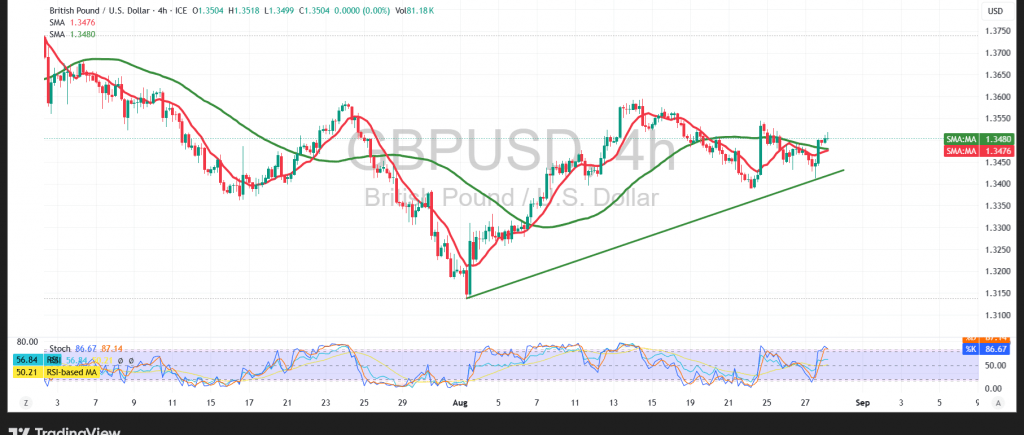

An uptrend has successfully taken control of GBP/USD trading, in line with the positive outlook highlighted in our previous technical report. The pair reached the projected target at the first resistance of 1.3500, recording a high of 1.3518.

Technical Outlook – 4-hour timeframe:

The price has firmly established itself above 1.3440, successfully retesting the ascending trend line. Simple moving averages have lifted previous downside pressure and now support the bullish outlook. Meanwhile, the Relative Strength Index (RSI) is approaching overbought levels, which may trigger a temporary slowdown in the upward move without undermining the broader uptrend.

Probable Scenario:

As long as the price remains above 1.3440, the bullish trend is expected to prevail, with upside targets at 1.3540 as the next resistance, followed by 1.3580. Conversely, a confirmed break below 1.3440 would reintroduce selling pressure, exposing the pair to a retest of 1.3400, with further downside toward 1.3375.

Fundamental Note:

Today’s session includes high-impact US economic data, namely the preliminary quarterly GDP reading and weekly unemployment claims, which may trigger sharp market volatility upon release.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3440 | R1: 1.3540 |

| S2: 1.3375 | R2: 1.3580 |

| S3: 1.3340 | R3: 1.3640 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations