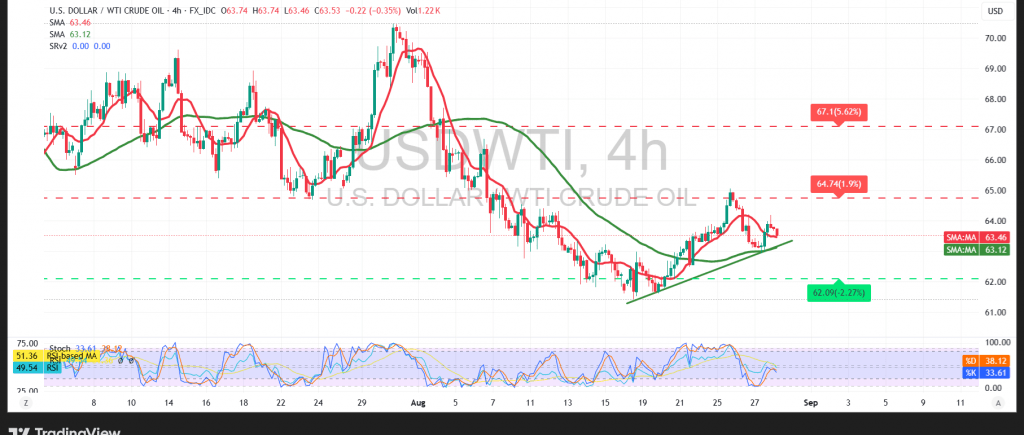

US WTI crude oil successfully established a base above the psychological support at $63.00, as highlighted in the previous report, and staged an upward rebound that reached the official target at $64.20 per barrel—the highest level of the last trading session.

Technical Outlook – 4-hour timeframe:

Current intraday movements show a mild downward correction, a natural reaction after testing the psychological resistance at 64.00 and facing profit-taking. Nevertheless, the simple moving averages continue to provide support, reinforcing the potential for further upside. While relative strength indicators are hovering in overbought territory, momentum signals remain positive, confirming short-term bullish dominance.

Probable Scenario:

As long as prices remain above the 63.00 support, the outlook favors a rising bottom formation. Upside targets begin at 64.20 as initial resistance, with a break above this level opening the way for further gains toward 64.80. Conversely, a confirmed hourly close below 63.00 would generate negative pressure, resuming the broader downtrend toward 62.40 as the first support, with the potential to extend lower toward 61.75.

Fundamental Note:

Traders are awaiting high-impact US economic releases today, including the preliminary quarterly GDP reading and weekly unemployment claims. These data may trigger strong price volatility upon release.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 63.00 | R1: 64.15 |

| S2: 62.40 | R2: 64.80 |

| S3: 61.75 | R3: 65.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations