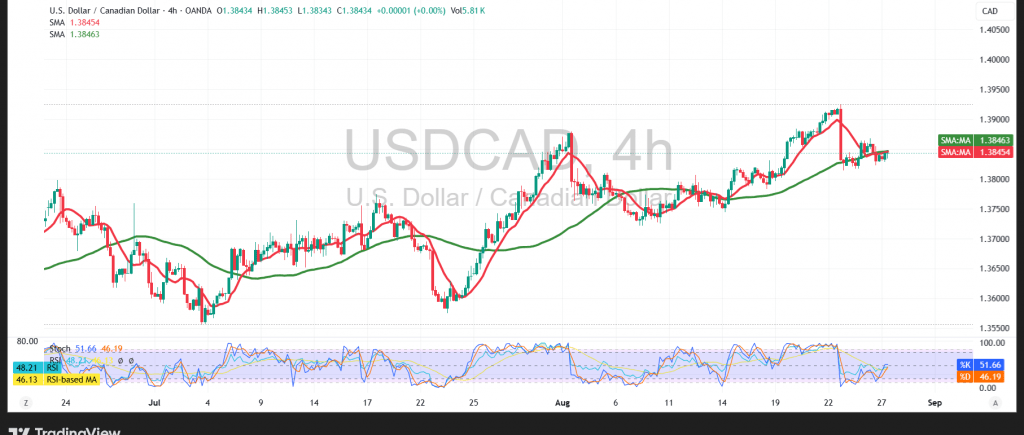

The technical outlook remains unchanged, with the USD/CAD pair continuing to trade in a sideways range as conflicting technical signals persist.

Technical Outlook – 4-hour timeframe:

The 50-period simple moving average is pressing down on the price from above, creating a resistance level that may limit upward attempts. At the same time, the Relative Strength Index (RSI) is showing early signs of positive momentum, suggesting a possible shift in bias.

Probable Scenario:

With mixed signals dominating, it is preferable to monitor price action to determine the next direction. A break below 1.3820 would trigger renewed downside pressure, opening the way for a retest of 1.3790, followed by 1.3750. Conversely, a confirmed break above the 1.3870 resistance would strengthen bullish momentum, providing an opportunity for the pair to advance toward 1.3900 and then 1.3930.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3825 | R1: 1.3870 |

| S2: 1.3790 | R2: 1.3900 |

| S3: 1.3740 | R3: 1.3935 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations