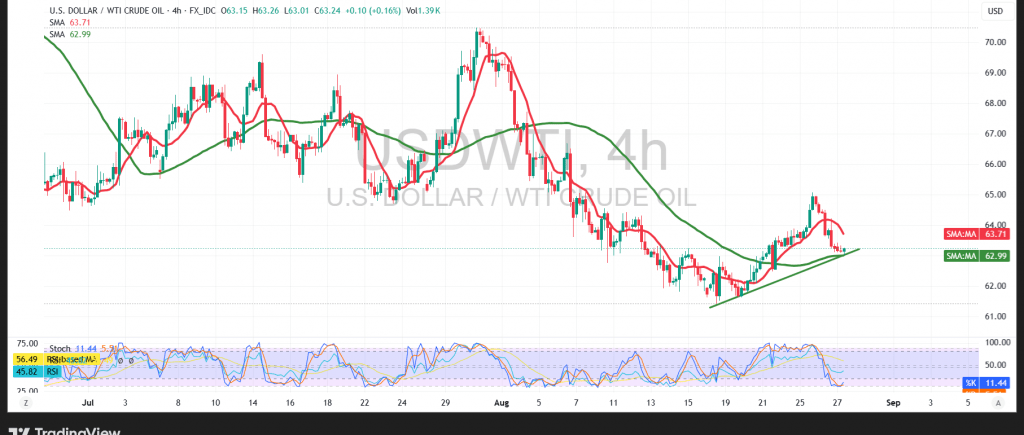

US WTI crude oil futures reversed the upward trend anticipated in the previous technical outlook, which had been based on trading above the 63.65 level, instead recording a low of $63.07 per barrel.

Technical Outlook – 4-hour timeframe:

The price is currently attempting to stabilize above the key psychological support at 63.00. Relative strength indicators have entered deeply oversold territory compared to price movement, raising the possibility of a positive divergence forming in the coming hours.

Probable Scenario:

As long as prices hold above 63.00, the likelihood of a rising bottom increases, with upside targets at 63.80 as initial resistance. A break above this level could pave the way for further gains toward 64.20. Conversely, a confirmed hourly close below 63.00 would add to downside pressure, reinforcing the bearish outlook with targets at 62.50 initially and potentially extending toward 62.00.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 62.50 | R1: 64.20 |

| S2: 61.95 | R2: 65.30 |

| S3: 60.90 | R3: 65.85 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations