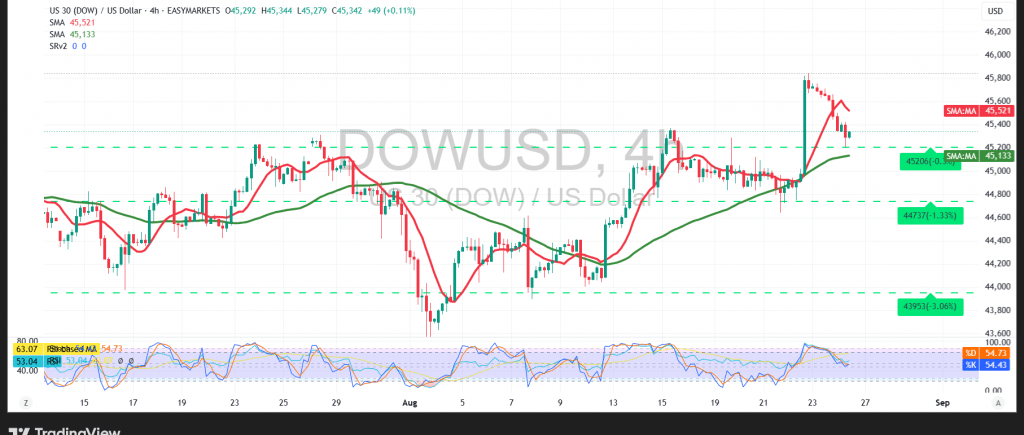

The Dow Jones Industrial Average (DJI30) witnessed bearish movements during yesterday’s trading session, following a series of record closings.

Technical Outlook for Today’s Session – 4-Hour Timeframe:

Technically, the 50-day simple moving average (SMA) is a barrier pressuring the price from above and acting as a resistance level. The RSI is also showing negative signs, remaining below the 50-day midline.

Probable Scenario:

As long as the price remains stable below 45,550, we may witness a decline in the coming hours, targeting 45,120. A break above this level could increase the chances of a decline towards 44,920.

Conversely, an hourly candle close above the 45,550 resistance level would lead the index to resume its upward trajectory, with targets at 45,630, followed by 45,920.

Warning: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios are likely to occur.

Disclaimer

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45120 | R1: 45630 |

| S2: 44910 | R2: 45920 |

| S3: 44610 | R3: 46130 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations