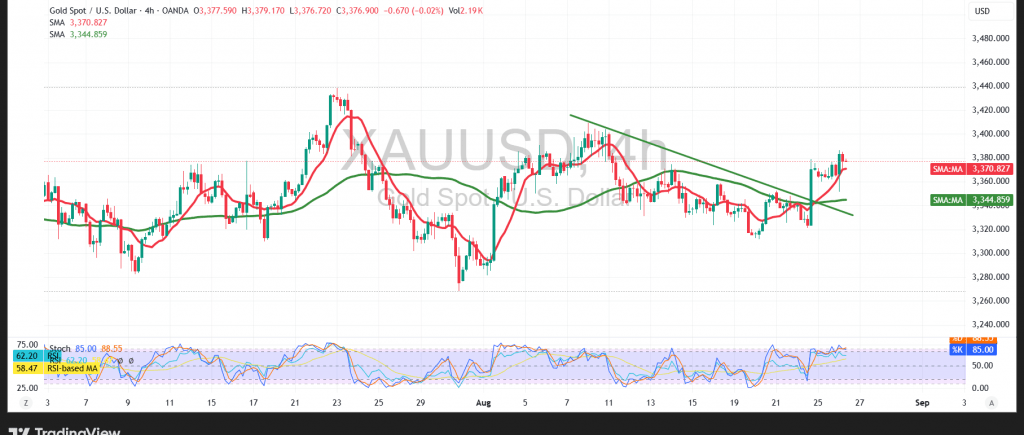

Gold prices (XAU/USD) traded in a narrow, sideways-to-negative range, reaching a low of $3,351 per ounce.

Technical Outlook – 4-hour timeframe:

Prices remain anchored by strong support at $3,355, which serves as a foundation for stability. The 50-period simple moving average is also acting as additional support, improving the chances of a potential rebound. Meanwhile, the Relative Strength Index (RSI) has exited overbought conditions, creating room for renewed upside movement.

Likely Scenario:

As long as trading holds above the 3,355 support level, the bias remains upward, with 3,385 as the first resistance, followed by 3,392 as the next target. A break above this zone would strengthen bullish momentum and could drive prices toward 3,406. Conversely, a confirmed break below 3,355 and sustained pressure to the downside would reintroduce selling, paving the way for a retest of 3,336 and then 3,322 as subsequent support levels before any potential rebound.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3357.00 | R1: 3392.00 |

| S2: 3336.00 | R2: 3406.00 |

| S3: 3322.00 | R3: 3427.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations