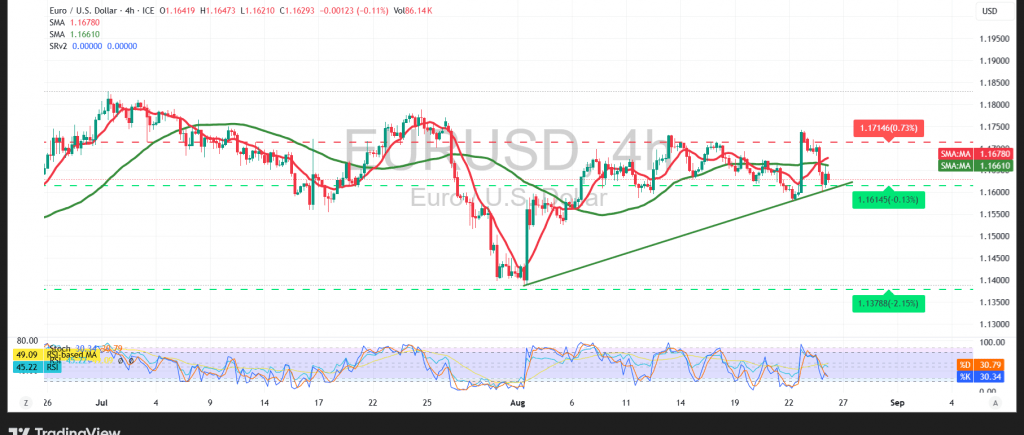

A bearish trend dominated the EUR/USD pair at the start of this week’s trading, erasing the gains it had previously achieved against the US dollar.

Technical Outlook – 4-hour timeframe:

The pair’s failure to hold above the psychological resistance at 1.1700 has led to renewed downside pressure, with current movements stabilizing near the daily low of 1.1628. The 50-period simple moving average continues to act as dynamic resistance, while persistent negative signals from the Relative Strength Index (RSI) confirm the dominance of bearish momentum.

Probable Technical Scenario:

As long as the pair remains below 1.1700, the bearish outlook prevails. A confirmed break below the 1.1600 support would reinforce downside momentum, opening the way toward 1.1530 as the first support, followed by 1.1460 as the next key target.

Conversely:

A clear breakout and sustained stability above 1.1700 could provide the pair with temporary relief, reducing recent losses and allowing for a rebound toward 1.1775, followed by 1.1830 as important resistance levels.

Warning: Risks remain elevated amid ongoing trade tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1580 | R1: 1.1700 |

| S2: 1.1530 | R2: 1.1775 |

| S3: 1.1455 | R3: 1.1830 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations