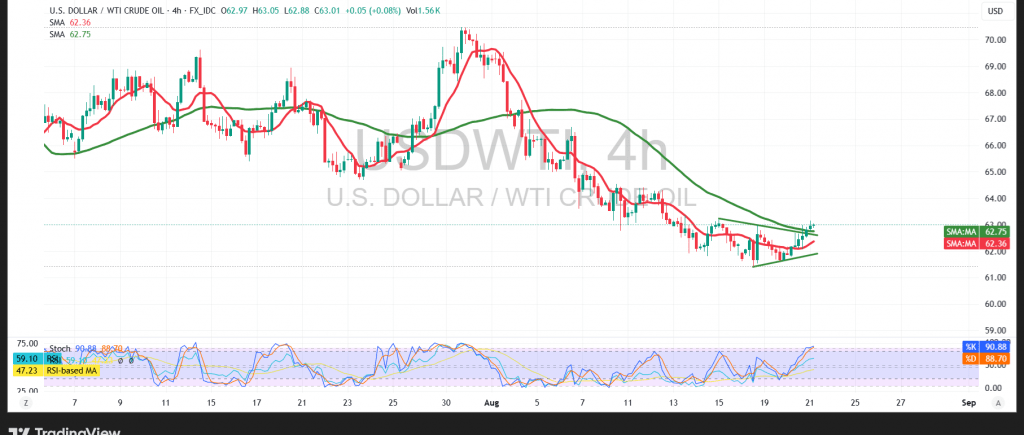

Prices for US crude oil futures (WTI) regained their upward trend during the previous session after successfully breaking the 62.50 resistance level. This led to a high of $63.15 per barrel.

Technical Outlook – 4-Hour Timeframe

Current movements show continued attempts at an upward rebound. The 50-day Simple Moving Average has turned into a support level, reinforcing the positive outlook. The Relative Strength Index is sending positive signals, reflecting the price’s attempt to gain additional momentum that could push it to higher levels.

Probable Scenario

With trading remaining stable above the 62.00 support level, the upward path remains dominant. A break above 63.45 would pave the way toward 63.95 as the first resistance, followed by 64.50 as a key resistance area.

If trading falls back below the psychological barrier of 62.00, it would create negative pressure that could reinforce a return to the downward path, with an initial target of 61.35.

Fundamental Note:

Today, we are awaiting high-impact economic data from the US economy: “Weekly Unemployment Claims, Preliminary Reading of the Services and Manufacturing PMI.” This data may cause strong price volatility when released.

Warning

- High Risk: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios may be plausible.

Disclaimer

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 62.15 | R1: 63.45 |

| S2: 61.35 | R2: 63.95 |

| S3: 60.80 | R3: 64.75 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations