The Dow Jones Industrial Average (DJI30) has shown a strong upward trend on Wall Street amid a series of record closes for the US stock market.

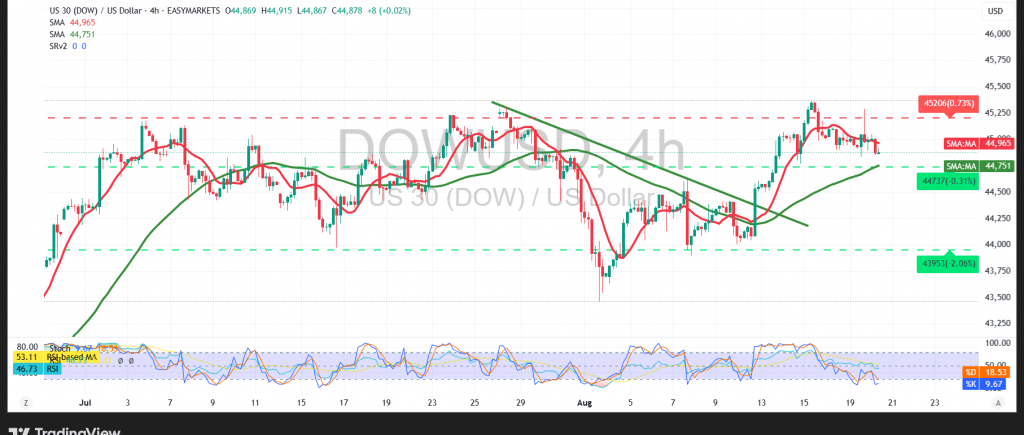

Technical Outlook – 4-Hour Timeframe

Technically, the index remains stable above the 50-day Simple Moving Average (SMA), which enhances the chances of a continued rise. However, the index is currently stable below the 45100 resistance level, accompanied by negative signals on the Relative Strength Index (RSI) as it attempts to correct from overbought conditions.

Probable Scenario

As long as the price is momentarily stable below 45100, we may see a minor bearish correction aiming to retest 44800 as the first support area. A break below this level could place the index under negative pressure, targeting 44720.

Note: This scenario does not contradict the overarching bullish trend, which is contingent on a confirmed breakout above 45110. Such a breakout could give the index an opportunity to resume its ascent toward 45175 and 45270.

Fundamental Note:

· High-Impact Data: Today, we are awaiting high-impact economic data from the US economy: the Federal Reserve’s FOMC Meeting Minutes. This data could cause strong price volatility upon its release.

Warning

The risk level is high amid current trade and geopolitical tensions, and all scenarios could be possible.

Disclaimer

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 44720 | R1: 45175 |

| S2: 44550 | R2: 45460 |

| S3: 44265 | R3: 45630 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations