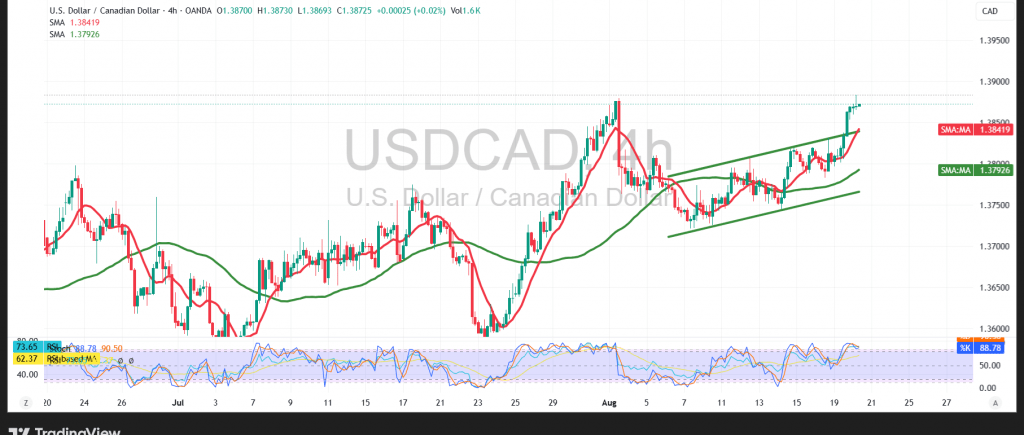

The USD/CAD pair has been dominated by an upward trend after recording repeated closes above the pivotal support level of 1.3800, which reinforces the pair’s positive outlook.

Technical Outlook – 4-Hour Timeframe

The pair is currently facing a strong resistance level around 1.3880. The Relative Strength Index (RSI) is clearly in overbought territory, which may give the pair an opportunity to correct this overbought condition. This does not contradict the overall daily uptrend.

Probable Scenario

We may see a limited bearish bias as long as instantaneous trading remains below 1.3880, with the goal of initially retesting 1.3820. It is important to note that a minor correction scenario does not negate the daily uptrend, whose targets are around 1.3940 and then 1.3980 once a breakout of the 1.3905 resistance level is confirmed.

Fundamental Note:

· High-Impact Data: Today, we are awaiting high-impact economic data from the U.S. economy: the Federal Reserve’s FOMC Meeting Minutes. This data could cause strong price volatility upon its release.

Warning

The risk level is elevated amid ongoing trade and geopolitical tensions, and all scenarios could be possible.

Disclaimer

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3820 | R1: 1.3905 |

| S2: 1.3760 | R2: 1.3940 |

| S3: 1.3730 | R3: 1.3990 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations