Gold prices (XAU/USD) experienced mixed but predominantly negative movement, reaching their lowest level in the previous session at $3,331 per ounce.

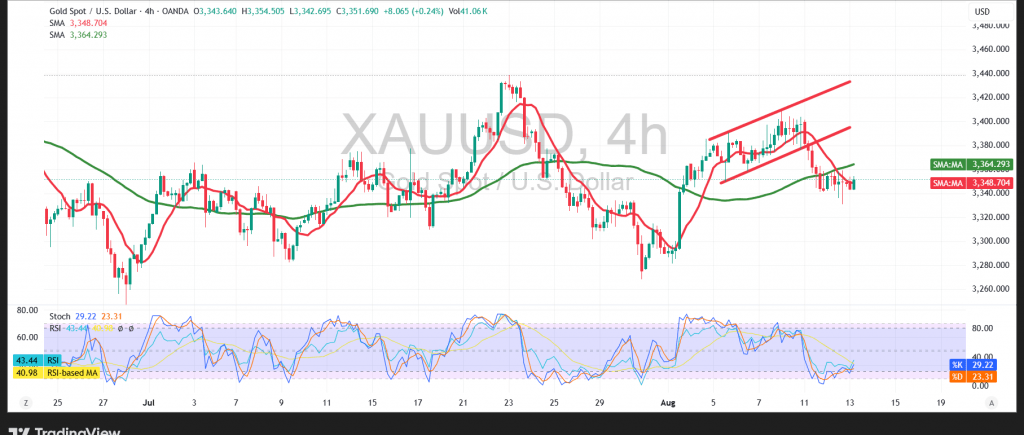

Technical Outlook – 4-hour timeframe:

During mid-day trading yesterday, gold attempted a modest rebound after the Relative Strength Index (RSI) entered sharp oversold territory, triggering limited upside movement. However, the 50-period simple moving average continues to act as a strong resistance barrier, while the break below the ascending trend line adds to the bearish technical bias.

Likely Scenario:

The bearish wave remains dominant, yet it is advisable to monitor price behavior closely for confirmation of the next move. A break above the resistance at 3,365 could pave the way for a recovery attempt toward 3,374, followed by 3,385. Conversely, failure to hold above 3,334 may renew selling pressure, driving prices toward initial support at 3,318 and potentially extending the decline to 3,306.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations