Gold prices are currently trading within a rangebound pattern, stabilizing above the strong support level at $3,310 while facing key resistance near $3,334.

Technical Outlook:

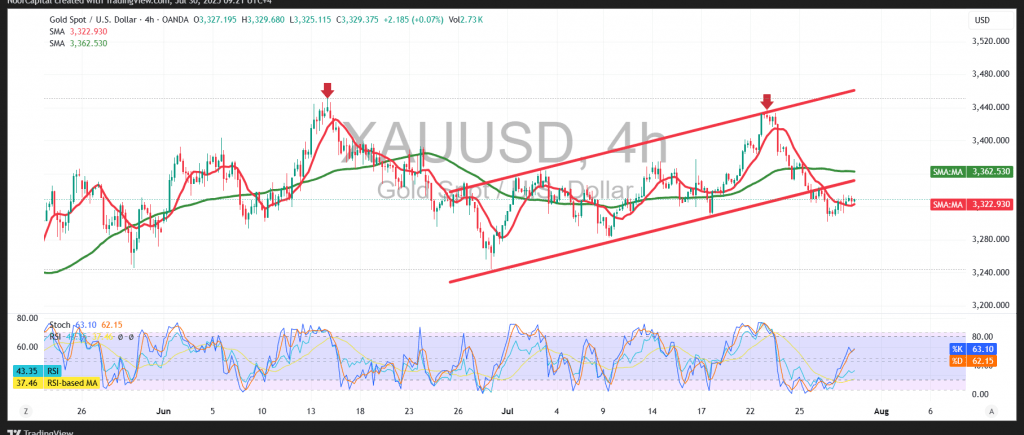

Price action shows limited bullish momentum following a rebound from the important psychological level at $3,300. However, the upside remains capped by the 50-period Simple Moving Average (SMA), which continues to act as a dynamic resistance level.

Meanwhile, the Relative Strength Index (RSI) has entered overbought territory, raising the possibility of a negative divergence forming, which could pressure prices lower in the short term.

Likely Scenario:

A confirmed break below the $3,308 support level may trigger further downside movement, with next targets at $3,297 and then $3,285.

As long as prices remain below the $3,334 resistance level, the bearish bias is expected to persist—especially following the recent break below the ascending price channel, as shown on the chart.

Alternative Scenario:

Should the price stabilize above the $3,334 resistance, this could initiate a short-term corrective rebound, with initial targets at $3,338, followed by a potential move toward $3,347.

Caution – High-Impact Events Ahead:

Today, the market awaits a series of key U.S. economic releases, including:

- Non-Farm Payrolls (ADP)

- Quarterly GDP figures

- Federal Reserve interest rate decision

- FOMC statement

- Press conference by Fed Chair Jerome Powell

These events are expected to generate elevated volatility across gold and other major assets.

Warning:

Market risk remains high amid ongoing geopolitical and trade tensions. Traders should remain cautious and prepare for sharp intraday price movements.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations