US President Donald Trump has announced that a trade deal has been struck between the US and the EU following a private meeting between the US president and the President of the European Commission, Ursula von der Leyen. The President of the European Commission confirmed there would be tariffs of 15% on goods from Europe across the board, lower than the rate of 30% previously threatened by the US. The agreement will include “zero for zero” tariffs on a number of products, including aircraft, some agricultural goods, and certain chemicals, as well as EU purchases of US energy worth 750 billion dollars over three years. “We have reached a deal. It’s a good deal for everybody”, Trump said on Sunday, July 27.

The week from Monday, July 21 to Friday, July 25, 2025, witnessed a significant impact from intricate and interwoven economic and political dynamics, with global markets reacting to pivotal developments including new trade agreements, robust corporate earnings, and speculation surrounding the Federal Reserve’s independence. U.S. stocks reached record highs, bolstered by the signing of a trade agreement with Japan, progress in U.S.-European Union trade talks, and exceptional financial performance by major corporations.

President Donald Trump’s visit to the Federal Reserve’s headquarters reignited discussions about potential administrative interference in monetary policy, particularly as the term of Federal Reserve Chair Jerome Powell nears its end in May 2026. With the Federal Open Market Committee (FOMC) meeting approaching on July 29-30, markets are closely monitoring critical economic data, including Gross Domestic Product (GDP), non-farm payrolls, and Personal Consumption Expenditures (PCE) inflation, signaling a summer filled with volatility.

Japan’s Landmark Deal

The U.S.-Japan trade agreement alleviated market uncertainty by reducing U.S. tariffs from 25% to 15% and including Japanese investments worth $550 billion in the United States. This deal boosted Japanese automakers’ stocks, such as Toyota (+5.2%), and led to a 4.1% rise in the Nikkei 225 and TOPIX indices. Agreements were also finalized with the United Kingdom, Vietnam, Indonesia, and partially with China, while negotiations with Canada, South Korea, and India continue ahead of the August 1, 2025, deadline.

Impact of Tariffs

The Trump administration is considering classifying copper as a critical mineral, potentially increasing U.S. tariffs to 50%, with implications for U.S. stockpiling and industrial demand. Failure to finalize remaining trade agreements could double the effective tariff rate to 20%, raising consumer prices by 1-2%. Current tariffs have already increased the effective tariff rate from 2% to 18%, adding approximately $2,400 annually to the costs of the average American household.

Market Performance

Gold

Gold futures declined by 0.94% to $3,337.07 per ounce by July 25, 2025, after peaking at $3,425.94. Forecasts suggest a potential rise to $3,675 per ounce by December 2025, driven by a 95% increase in central bank holdings and a 12% annual rise in Chinese demand.

Crude Oil

West Texas Intermediate (WTI) crude futures closed at $62.50 per barrel, down 1.8%, while Brent crude closed at $68.29, down 1.41%. Easing concerns about supply disruptions in the Middle East impacted prices, though they remain sensitive to geopolitical and trade developments.

Silver

Silver prices settled at $38.16 per ounce, down 2.3%, with expectations of reaching $42 per ounce by December 2025, supported by a 20% increase in industrial demand for solar panel production and its role as a safe-haven asset linked to gold.

Copper

Copper prices rose 2.3% to $8,900 per ton, with projections to reach $9,350 per ton by December 2025. Demand in renewable energy and infrastructure sectors, combined with potential 50% tariffs, supports bullish expectations.

U.S. Stocks

The S&P 500 (+1.5%, 6,395.82), Nasdaq (+1.0%, 21,108), and Dow Jones (+1.3%, 44,902) hit record highs, achieving 11 new peaks in 30 days. Approximately 67% of S&P 500 companies exceeded revenue expectations, and 83% surpassed earnings forecasts, with revenue growth of 4.76% and earnings per share growth of 8.29% annually. Major banks like JPMorgan (+3.1%) and Citibank (+2.8%) performed strongly, while Alphabet (+4.38%) led technology stocks due to cloud computing growth. Conversely, Tesla declined 4.12% due to weak revenues.

Cryptocurrencies

Bitcoin closed at $119,100, while Ethereum gained 1.2% weekly at $3,610. Cautious optimism, supported by expectations of rate cuts and increasing institutional adoption (5% of S&P 500 companies hold cryptocurrencies), drives market sentiment.

Bond Markets

The 10-year U.S. Treasury yield stabilized at 4.38%, with investment-grade corporate bonds outperforming as spreads narrowed to 90 basis points. Bonds with 7-10 year maturities, offering yields around 5%, remain attractive for stability-seeking investors.

Global Markets

The MSCI EAFE index rose 2.8%, driven by strong performance in Japan and Europe (DAX +2.5%). Emerging markets gained 2.1%, with attractive valuations at a price-to-earnings ratio of 12x compared to 22x for U.S. markets.

US Dollar

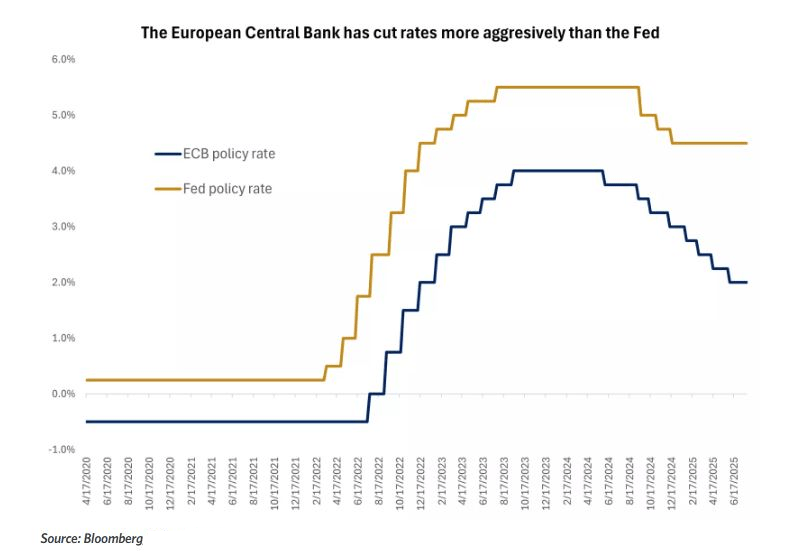

During the week of July 21-25, 2025, the U.S. dollar exhibited mixed performance against major currencies. On July 24, 2025, the European Central Bank maintained interest rates unchanged at 2.15% for main refinancing operations, 2.00% for the deposit facility, and 2.40% for the marginal lending facility, citing persistent inflation at 2.5% and escalating global trade tensions necessitating a cautious approach. The dollar rose 0.06% against the euro, with the EUR/USD pair trading at 1.17517, supported by expectations that the Federal Reserve would maintain interest rates at 4.25%-4.50% amid robust economic data. Against the Japanese yen, the dollar remained nearly stable (USD/JPY at 147.718, +0.07% daily, -0.64% weekly), influenced by the U.S.-Japan trade agreement, which bolstered confidence in the yen, with limited volatility of 0.06%.

Against the British pound, the dollar gained 0.68% over the week (USD/GBP at 0.74445, +0.04% daily), supported by cautious optimism ahead of Federal Reserve decisions. The dollar also increased by 0.37% against the Swiss franc (USD/CHF at 0.79547, +0.06% daily), driven by safe-haven flows toward the dollar, per TradingView data. These movements reflect market reactions to trade developments and monetary policy expectations, with relative stability in the markets during this week.

The Week Ahead: Pivotal Events

The upcoming week is expected to feature a series of critical events influencing markets:

Federal Reserve Decision (July 29-30): Interest rates are expected to remain unchanged, with Jerome Powell’s press conference anticipated to provide insights into future monetary policy.

Gross Domestic Product (July 31): Forecasts indicate 1.5% growth for the second quarter, though inventory stockpiling may distort figures.

Non-Farm Payrolls (August 1): Expected to reflect a slowing labor market, with unemployment at 4.2%.

Corporate Earnings: Major companies like Microsoft, Meta, Apple, and Amazon will announce results, guiding the trajectory of technology stocks.

Trade Negotiations: Ongoing talks with China in Sweden (July 28-29) and a court review of tariff legality (July 31) will shape trade policy.

Experts recommend focusing on large and mid-cap U.S. stocks in financials, healthcare, and discretionary consumer goods due to their strong performance and stability. Investment-grade bonds with 7-10 year maturities offer attractive yields with relatively low risk. Traders are advised to capitalize on market dips as buying opportunities, while remaining cautious of volatility stemming from trade uncertainties and geopolitical developments. Cautious optimism prevails, with future performance hinging on trade negotiation outcomes and upcoming macroeconomic data.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations