The U.S. dollar posted weekly gains after prevailing over a range of competing market forces throughout the past week.

President Donald Trump last week threatened to impose a 30% tariff on the European Union and Mexico, effective August 1st.

Market turbulence—sparked by President Trump’s remarks and trade policy actions—persisted throughout the week, fueling deep concern over the future of global commerce, free trade, and the broader impact of tariffs on major economies.

The latest episode in the tariff threats saga focused on Canada, with Trump warning of a 35% tariff on Canadian imports. He also signaled potential duties ranging from 15% to 20% on several other U.S. trade partners.

Trump reiterated the threat of a 30% tariff on the European Union, scheduled to take effect at the beginning of August.

Collectively, these warnings have amplified expectations of rising inflation in the United States, potentially deterring the Federal Reserve from cutting interest rates in the near term.

Inflation Data

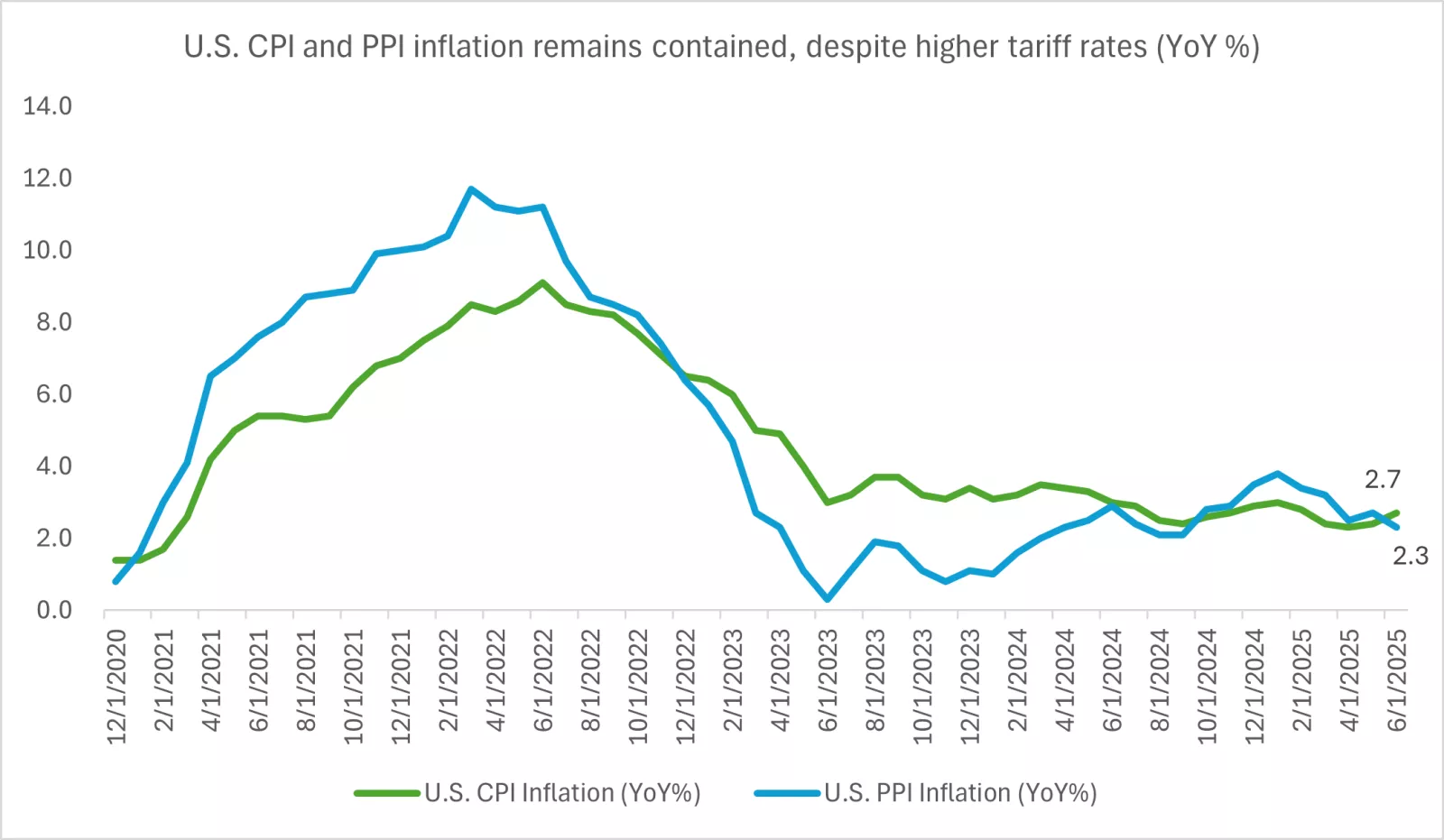

Last week’s U.S. consumer price data underscored a rise in inflation for June, with monthly CPI increasing by 0.3%, up from 0.1% in May. The figure came in just below market forecasts of 0.3%.

The annual CPI rose 2.7% in June, compared to a 2.4% increase in the same month last year, aligning with market expectations.

Looking at core readings—excluding more volatile components like food and energy—core CPI climbed 0.2% in June, down from 0.3% previously, yet came in above the market’s expected 0.1%.

Annual core inflation reached 2.9%, slightly up from May’s 2.8%, but falling short of the market’s 3.0% forecast.

These figures shed light on the continued upward pressure on inflation and the potential for further escalation, driven by looming tariff threats.

Sources at the White House told the Financial Times that President Trump, in a meeting at the Oval Office last Tuesday, discussed with Republican members of Congress the possibility of dismissing Jerome Powell from his role as Federal Reserve Chair.

The Powell Battle

President Donald Trump stated last week that there is a “high likelihood” Jerome Powell will not be removed from his position, despite internal discussions within the presidential team regarding whether the Fed Chair should step down.

Sources added that U.S. lawmakers attending the meeting expressed support for relieving Powell of his duties.

Republican Congresswoman Anna Paulina from Florida posted on social media platform “X” that she had “heard” Powell would be dismissed “soon.”

However, sources indicated a divide within the administration over whether Powell should be removed in the near term.

Economic Data

Weekly jobless claims declined more than expected, reaching their lowest level in three months. Retail sales for June also exceeded expectations, while the Federal Reserve Bank of Philadelphia’s business outlook survey for July registered its highest reading in five months.

The currency received additional support from comments by Federal Reserve Governor Adriana Kugler, who indicated that it would be appropriate for the Fed to keep interest rates unchanged “for some time.”

Remarks from the Federal Reserve

The currency received a boost from comments by Federal Reserve Governor Adriana Kugler, who stated it would be appropriate for the Fed to maintain interest rates “for some time.”

Federal Reserve Board member Christopher Waller noted, “With inflation nearing target and limited upside risks, we shouldn’t wait for labor market conditions to deteriorate before cutting rates.”

He added, “I believe it makes sense for the Federal Open Market Committee to lower rates by 25 basis points two weeks from now.”

U.S. Equities and Sharp Gains

While factors contributing to the U.S. dollar’s weekly advance could have pushed New York Stock Exchange indices toward losses last week, a series of positive developments—including economic data and earnings reports—helped lift U.S. equities, enabling them to register weekly gains.

Weekly jobless claims fell more than expected to a three-month low, June retail sales outpaced forecasts, and the Philadelphia Fed’s July business outlook survey hit a five-month high.

Earnings reports from the financial sector also supported U.S. equities last week, as results revealed that profits and revenues for most major financial firms exceeded market expectations.

Citigroup posted second-quarter earnings that surpassed market projections, supported by growth across all divisions of the banking giant. Earnings reached $1.96 per share versus the $1.60 per share forecast by LSEG.

Revenue climbed to $21.67 billion, beating LSEG’s earlier estimate of $20.98 billion.

Global financial firm Wells Fargo also delivered stronger-than-expected earnings in Q2, though its stock fell roughly 2.00% during Tuesday’s NYSE session. The bank, the fourth-largest in the U.S., reported net income of $5.49 billion, or $1.60 per share.

BlackRock became the only asset manager with invested assets exceeding $12 trillion, reaching $12.53 trillion in Q2 according to earnings disclosures. The company reported earnings of $12.05 per share, outpacing Zacks Investment Research’s forecast of $10.66. However, revenue slightly missed expectations at $5.43 billion.

Despite the earnings beat, BlackRock shares declined due to negative elements in the report.

Bank of America also reported earnings above market forecasts in Q2, according to earnings released Wednesday. Quarterly revenue and profits both came in stronger than expected.

The bank posted earnings of $0.89 per share, surpassing LSEG’s previous forecast of $0.86 per share. Revenue reached $26.61 billion, slightly below LSEG’s projection of $26.72 billion.

Euro Sees Limited Weekly Gains

The euro was among last week’s gainers, although its advance was modest, with weekly gains capped below 0.1%.

Support for the single European currency came primarily from economic data and intermittent U.S. dollar weakness. However, several negative market factors weighed on sentiment throughout the week, including concerns over potential tariffs targeting the European Union starting next month.

Additional pressure emerged from statements by European policymakers advocating further rate cuts, which contributed to losses for the currency.

The ZEW Economic Sentiment Index rose to 52.7 points from 47.5 in the previous month.

Industrial production in the eurozone also strengthened, with monthly and annual readings for May climbing to 1.7% and 3.7%, respectively, compared to previous figures of 1.0% and 2.2%.

The euro’s weekly gains were also bolstered by dollar softness amid headlines discussing the possible dismissal of Jerome Powell as Federal Reserve Chair.

President Trump threatened to impose a 30% tariff on both the European Union and Mexico, set to take effect on August 1st.

These threats have heightened expectations of rising inflation in the U.S., which could discourage the Federal Reserve from cutting interest rates in the near term.

The euro was further impacted by comments from Antonio Tajani, Deputy Prime Minister of Italy—the eurozone’s third-largest economy—who expressed support for continued rate cuts.

Tajani stated the European Central Bank should “consider a new asset purchase program under quantitative easing, along with further interest rate reductions.”

Sterling Posts Weekly Losses Despite Supportive Data

The British pound ended last week on a downward trend, giving up roughly 0.6% by Friday’s close.

The currency faced selling pressure primarily due to the U.S. dollar’s weekly strength, which was supported by hawkish Federal Reserve remarks, ongoing tariff uncertainty triggered by President Trump’s threats, and favorable economic data—most notably inflation figures.

Conversely, sterling received support from inflation data highlighting continued price pressures. U.K. consumer prices rose to 3.6% in June, up from 3.4% previously. Core inflation—excluding food and energy—climbed 3.5% month-over-month and 3.7% year-over-year.

The U.K. economy added 134,000 jobs in the three months ending in May, significantly exceeding market expectations for a 46,000 job increase.

The unemployment rate declined to 4.6% during the same period, down from 4.7%, attributed to higher labor force participation.

Oil Suffers Significant Losses

President Donald Trump last week threatened Russian President Vladimir Putin with sanctions on Russian oil exports should no peace agreement be reached in Ukraine within fifty days.

While such threats were expected to push global oil prices higher, several prevailing market factors prevented that outcome.

Among them were Trump’s additional tariff threats, set to take effect on the first of next month, which raised concerns over a slowdown in global economic activity—typically leading to weaker oil demand worldwide.

U.S. crude oil inventories also saw a sharp rise last week, highlighting softening demand in the world’s largest economy. Inventories increased by 19.1 million barrels, compared to the prior week’s 7.1 million barrel build.

A stronger U.S. dollar also weighed on oil prices, as dollar-denominated commodities generally decline when the currency appreciates.

Further downward pressure stemmed from U.S. economic data showing continued consumer price inflation. The inflation uptick is seen as a signal that the Federal Reserve may maintain elevated interest rates for longer, dampening economic momentum and, in turn, global oil demand.

Trump’s threat of sanctions against Russia lacked sufficient force to move global oil prices, as financial market participants viewed the warnings as lacking concrete measures.

Cryptocurrencies

Despite posting weekly losses, Bitcoin reached two unprecedented price levels last week.

The cryptocurrency surged past $22,000 and $23,000 per unit, marking historic milestones.

Driving this rally was President Trump’s approval of a comprehensive tax cut and public spending bill, expected to result in a significant fiscal deficit and weaken the U.S. dollar.

Additionally, U.S. consumer inflation data suggested a possible resurgence in price pressures in the coming period, further weighing on the dollar.

As a result, demand for Bitcoin increased as an alternative store of value to the U.S. dollar, amid concerns over potential erosion in savings and investment value due to a weakening currency.

The Week Ahead

The coming week features a range of key developments, including economic data releases, earnings reports, and remarks from monetary policymakers.

A series of Purchasing Managers’ Index (PMI) readings are scheduled for release, offering insight into overall economic activity.

Housing data, employment figures, and U.S. durable goods orders are also due.

Federal Reserve Chair Jerome Powell is set to speak next week at the Fed’s banking conference.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations