Gold prices exhibited mixed but upward-biased movement, with the metal maintaining its position above the pivotal support area at $3,310, preserving a positive short-term outlook.

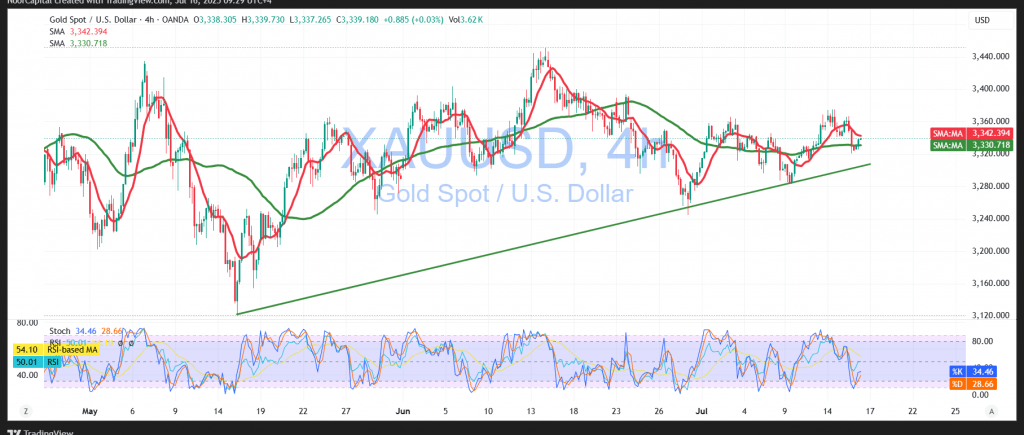

Technical Outlook – 4-Hour Timeframe:

Intraday price action reflects a continuation of the bullish trend, following a solid bounce from $3,310. This support level allowed gold to break above and stabilize above the 50-period Simple Moving Average (SMA)—a positive technical signal. Additionally, the Relative Strength Index (RSI) has resumed upward movement, suggesting renewed bullish momentum.

Probable Scenario – Bullish Bias:

The upward trend is expected to continue, with $3,358 as the initial resistance level. A successful breakout above this barrier could open the way for further gains toward $3,376.

Alternative Scenario – Bearish Risk:

If the price fails to hold above $3,315, and more critically below $3,310, the bearish scenario may be reactivated. In this case, downside targets would be:

- $3,290 (first support)

- $3,272 (subsequent support)

Caution:

Risk remains high amid persistent geopolitical and trade-related tensions. All scenarios are possible, and traders are advised to apply rigorous risk management.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations