Gold began the week with strong upward momentum, reaching its highest level in three weeks at $3,375 per ounce. This move aligns with the bullish scenario outlined in the previous technical report, which identified $3,360 as the initial resistance target.

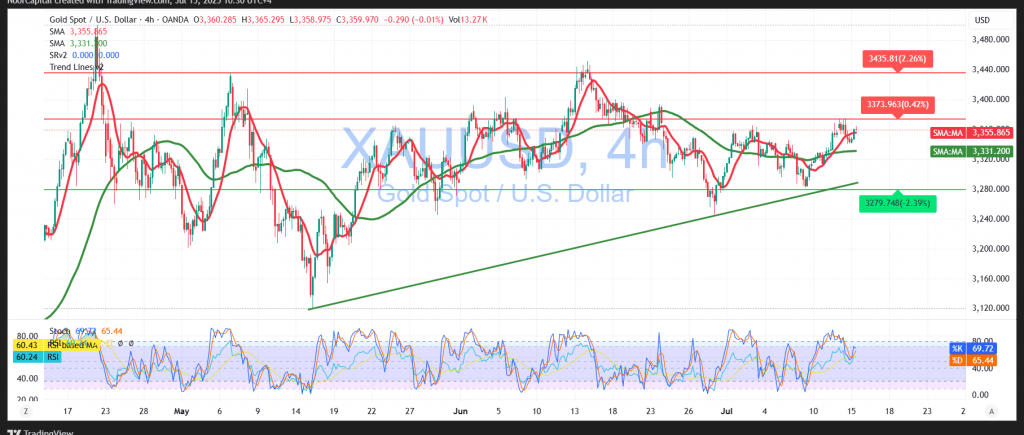

Technical Outlook – 4-Hour Timeframe:

Gold has established a solid support base around $3,340, which has provided fresh bullish momentum. This is supported by the simple moving averages, acting as dynamic support, and an improving Relative Strength Index (RSI), signaling a gradual recovery in upward momentum.

Probable Scenario – Bullish Bias:

As long as gold holds above $3,340, the bullish outlook remains favored, with $3,376 as the immediate resistance level. A breakout above this point would likely accelerate gains toward the next technical target at $3,392.

Alternative Scenario – Bearish Reversal:

Failure to maintain price action above $3,340 could reactivate a corrective bearish scenario, initially targeting $3,324, with a further decline toward $3,310 if pressure intensifies.

Market Catalyst:

High-impact U.S. economic data is expected today, including monthly and annual Core Consumer Price Index (CPI) reports. This release may trigger significant price volatility across gold and dollar-related assets.

Caution:

Risk remains elevated amid persistent geopolitical and trade uncertainties. All market outcomes are possible, and traders should implement strict risk management.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations