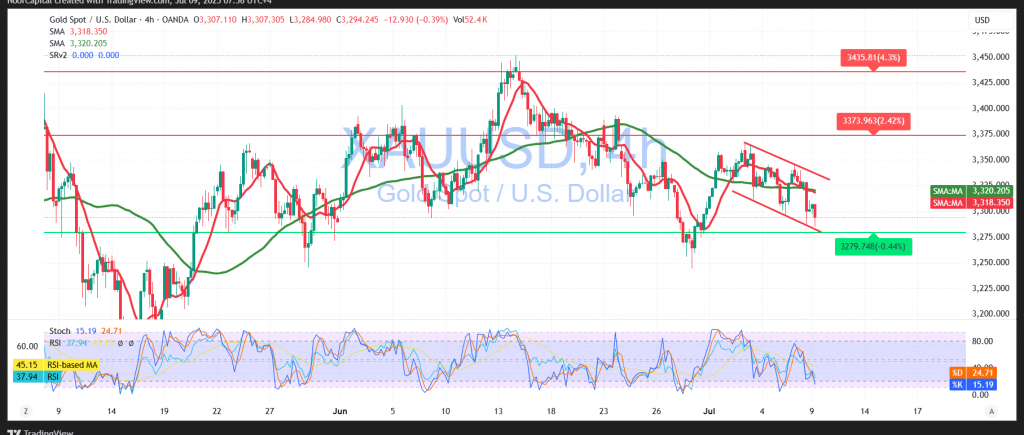

Gold prices failed to maintain their upward momentum and began today’s session under renewed selling pressure, breaching the key support level at $3295 — a level we previously identified as a critical threshold for sustaining the bullish outlook. In early trading, gold dipped to a low of $3284 at the time of writing.

Technical Outlook:

Despite prices holding below the simple moving averages, the $3295 level continues to act as a major support, limiting further declines. Additionally, the Relative Strength Index (RSI) has exited oversold territory, showing early signs of recovery and increasing the probability of a short-term bullish rebound.

Expected Scenario:

As long as we do not see a confirmed close below $3295 (at least on an hourly candle), the potential for a recovery remains intact, with initial upside targets at:

- $3320 as the first resistance level

- A break above $3320 would likely extend the rebound toward $3360

On the other hand, renewed pressure and a confirmed break below $3295, particularly if gold falls through $3280, would reactivate the bearish scenario. This would open the door to further declines toward:

- $3275

- Followed by $3269

Market Catalyst:

Traders should stay alert ahead of today’s release of the U.S. Federal Reserve meeting minutes—an event expected to inject significant volatility into the markets.

Caution:

Risk remains elevated due to persistent geopolitical and trade tensions. All scenarios are possible, and prudent risk management is strongly advised.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations