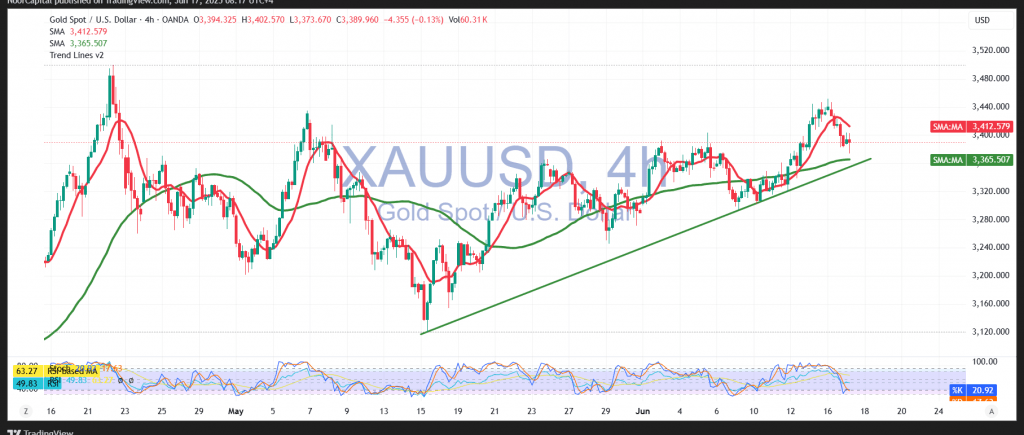

Gold experienced a downward trend during yesterday’s session, moving within a weak and somewhat indecisive pattern that deviated from the anticipated bullish outlook. Despite this, the price remained above the key support level of $3,390, recording a session low at $3,373 per ounce.

From a technical standpoint, today’s outlook remains positive. The simple moving averages continue to offer upward support, reinforcing the prevailing bullish structure. Additionally, gold has successfully cleared overbought conditions, with the Relative Strength Index (RSI) beginning to signal renewed bullish momentum.

This suggests that the likelihood of an upward continuation remains strong. A confirmed breach of the $3,403 level would ease the path toward the first target at $3,436, with further gains potentially extending to $3,452.

It is important to note that maintaining daily closes above the significant demand zone at $3,360 is essential to validate the bullish scenario. A drop below this level could jeopardize the current upward outlook.

Warning: U.S. retail sales data is scheduled for release today, which could trigger high market volatility.

Warning: Risk levels are elevated amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations