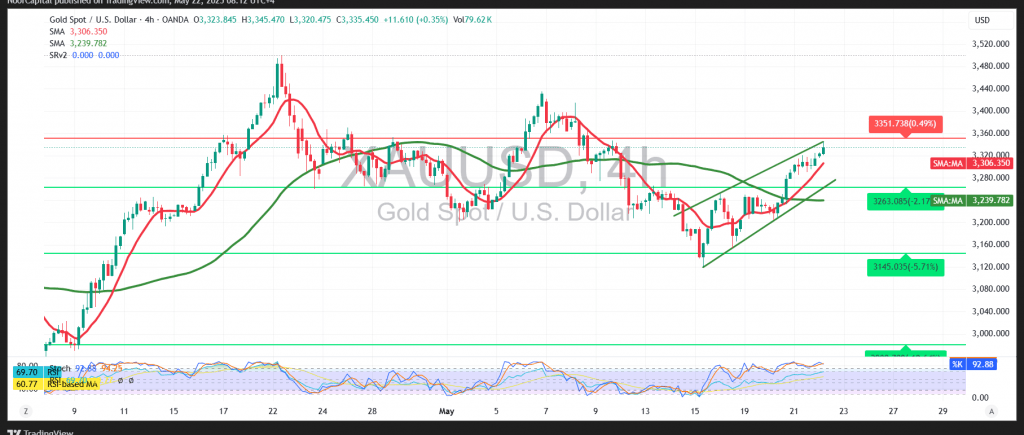

Gold prices have surged in recent intraday trading, breaking decisively above the key $3,270 resistance level and reaching a new high of $3,345.

From a technical analysis perspective, the bullish trend remains firmly in place. The Relative Strength Index (RSI) continues to gain upward momentum, holding above the 50 midline, while the simple moving averages have formed a positive crossover—further supporting the bullish case.

As long as intraday trading remains above $3,297, and more broadly above $3,261, the bullish outlook remains favorable. The next upside target is seen at $3,357, and a confirmed break above this level would likely open the door for further gains toward the $3,380 resistance zone.

However, a failure to hold above the $3,260–$3,261 support region would likely halt the current uptrend and shift the bias to the downside. In this case, gold may enter a corrective phase, with initial downside targets at $3,237 and potentially lower.

Key Event Risk Today:

High-impact Services and Manufacturing PMI data will be released from the United States, Eurozone, and United Kingdom. These reports could trigger heightened volatility in gold and broader markets.

Risk Disclaimer:

Given ongoing global trade tensions and major economic data releases, market conditions remain volatile. Traders should stay cautious and be prepared for sharp price fluctuations in either direction.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations