Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling to a low of $3,148 during early trading today.

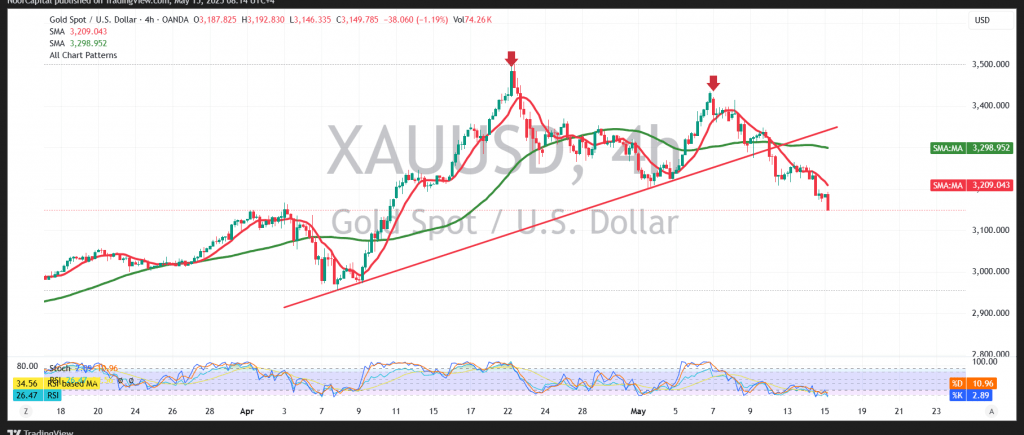

From a technical perspective, the 4-hour chart reveals a clear break below a major ascending trendline, confirming the dominance of a corrective bearish phase. Additionally, continued negative pressure from the simple moving averages further supports the short-term bearish outlook.

As long as trading remains below the psychological resistance at $3,200—and more importantly, below $3,220—the downward corrective trend remains the favored scenario. In this context, the next immediate target is $3,112, with a confirmed break below this level likely to extend the decline toward $3,075.

However, a return to stable trading above $3,220 could signal a potential recovery. In such a case, short-term bullish momentum may resume, with initial upside targets at $3,250.

Key Event Risk Today:

Markets may see elevated volatility in response to key U.S. economic data releases, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

These announcements could significantly influence gold prices and broader market sentiment.

Risk Disclaimer: With persistent global trade tensions and heightened economic uncertainty, market risk remains elevated. Traders should manage exposure carefully and prepare for a range of outcomes.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations