US Dollar closed the week higher, making use of a number of developments, including reaching a trade deal between USA and UK and announcing a starting point of trade talks between Washington and Beijing this weekend.

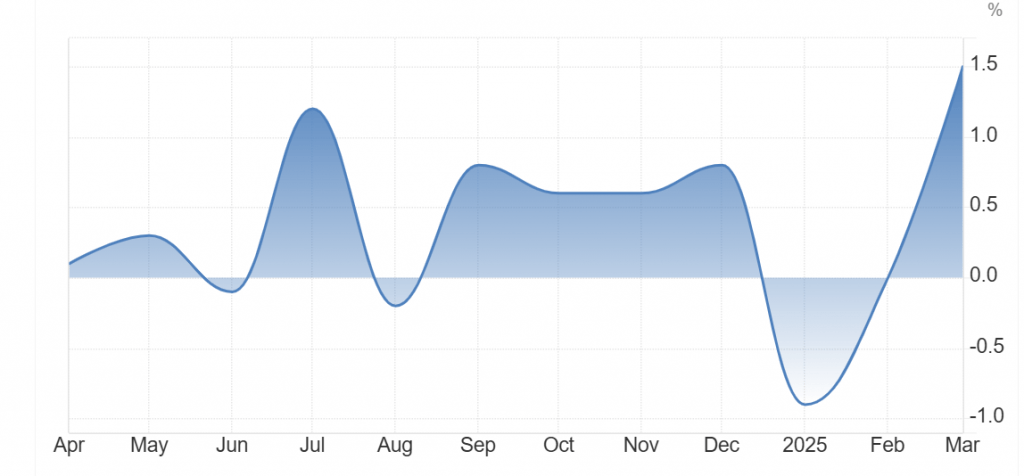

The currency also soared after Federal Reserve Bank kept rates unchanged in May meeting with adopting a language inclined to maintaining the current policy stance for some times until things get clearer.

US jobless claims fell to levels under expectations alongside increase in labour cost in Q1, which is hawkish for the Fed and supports the greenback.

The currency is expected to kick off the new week trading in the upside buoyed by a carryover support from Fed’s rhetoric and cautious optimism around US – China trade talks in Switzerland.

Limited losses for US stocks

US stocks closed trading week lower after the Fed kept interest rate and monetary policy stance unchanged in May meeting last week as the decisions maintain quantitative tightening, which provides an unfriendly environment for risky assets.

The Fed and its chief Jerome Powell also stressed slower growth, higher inflation, and higher unemployment as the potential characteristics of US economy in the future, which add downside pressure in stocks.

Some negative earnings contributed to the limited losses in NYSE, including Ford. The car giant suspended its revenues outlook and other food brands reported poor financial results in Q1.

John Williams, New York Fed’s chief also contributed to US stocks weakness throughout the week ended on May 9 as his statements was loaded with expectations of stagflation after he said that US economy could face slower growth, higher inflation, and higher unemployment.

There were other developments, which added to downside pressures in US equity market, including a proposal by US president Donald Trump of 80% China while Beijing reiterated US should cancel tariffs ahead of trade talks. The rhetoric was also negative for the stocks.

US, and global stocks in general, could restore uptrend if there receive positive notes from the US- China trade talks.

Any positive reading regarding US CPI and consumer confidence in the new week could boost stocks.

Gold was a winner

Gold futures managed to make big gains last week buoyed by a number of factors on the ground, including Trump’s statements in which he said he isn’t planning to speak to is Chinese counterpart Xi Jinping soon.

US trade deficit widened to a record high ($-140.5 B), which is bearish for GDP.

The reading sent more negative tone for markets and dumped US dollar as most views include that tariffs were behind last week contraction of GDP by -0.3% in Q1, according to last week’s data. The readings were also useful for the precious metal.

Although trade talks between Washington and Beijing kicked off this weekend – amid confirmation of breakthrough progress – gold was a winner last week for the same reason as there was a proposal by US president Donald Trump of 80% China while Beijing reiterated US should cancel tariffs ahead of trade talks. The rhetoric was also positive for the yellow metal.

If investors focussed such progress with more preliminary details about a potential US-Chinese trade deal in market headlines, we could see downside pressure on gold.

We also have US CPI inflation and consumer confidence this week, which could harm the metal in case CPI shoed retracement with improvement in consumer sentiment.

Japanese Yen was pressured

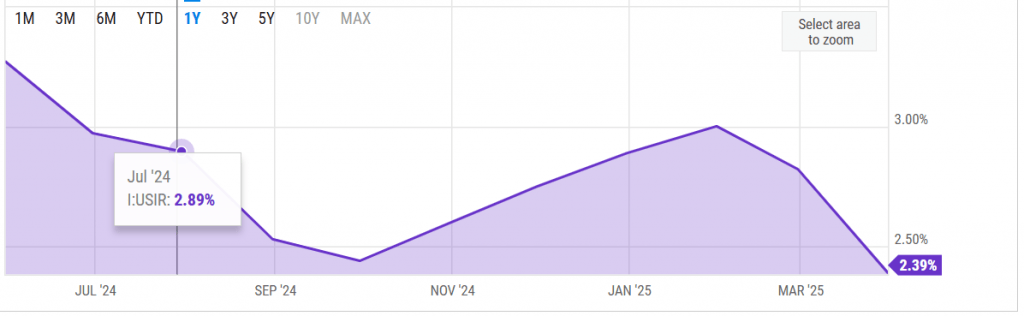

The Japanese currency closed last trading week lower because of the inverse correlation with US bond yields which made remarkable gains.

The surge in yields was buoyed by some developments, including Trump’s statements in which he said he isn’t planning to speak to is Chinese counterpart Xi Jinping soon. The statements were made before announcing that kick off of trade talks between Washington and Beijing would be in this weekend.

The language of Federal Reserve Bank and its chief Jerome Powell remarks – after keeping interest rate unchanged – was one of the main reasons why T-notes yields surged while the yen declined.

Federal Reserve Bank kept rates unchanged in May meeting with adopting a language inclined to maintaining the current policy stance for some times until things get clearer.

Cryptocurrencies: bitcoin above $100000

When Trump announced a comprehensive trade deal with UK, risk appetite strongly improved.

Risky assets in financial markets moved higher, including S&P500 stock index which is positively linked to bitcoin, The result was a rise above $100000 and sill advancing.

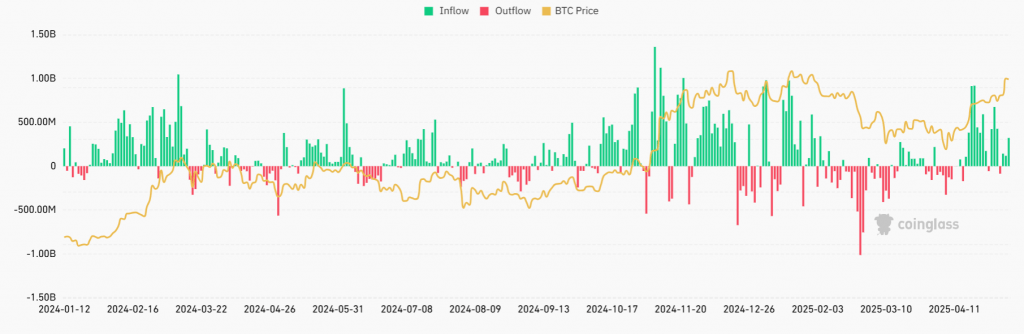

There were also strong support from institutional demand, which led to huge purchases and increased ETFs cryptocurrencies inflows.

Bitcoin made big gains buoyed by institutional demand, which was evident in bitcoin ETFs inflows increase by $ 425.45 m last week.

Semler Scientific and Strategy added 167 and 1,895 BTC, respectively, totalling $196.50 m.

Institutional investors ramped up ETF inflows, with ARK 21Shares, Fidelity and BlackRock leading the charge.

The new week

Important economic releases this week include CPI inflation data and a read on consumer sentiment.

We should also follow for any development regarding US-China trade talks which kicked off this weekend.

Retail sales are also of high importance as it spotlights consumer spending, which is a main clue of demand and inflation expectations.

Walmart is scheduled to release its quarterly earning report this week, which could add to the bigger picture of consumer spending with retail sales.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations