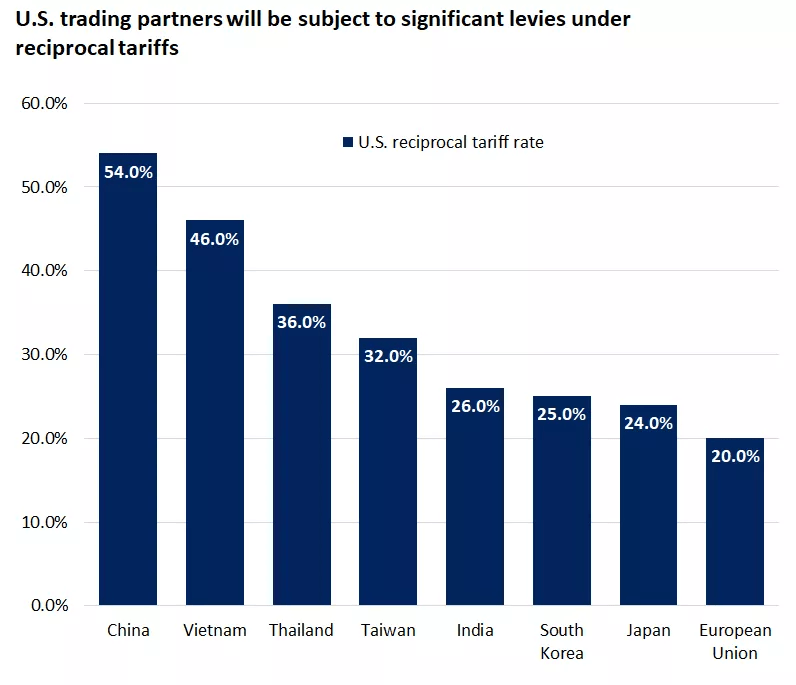

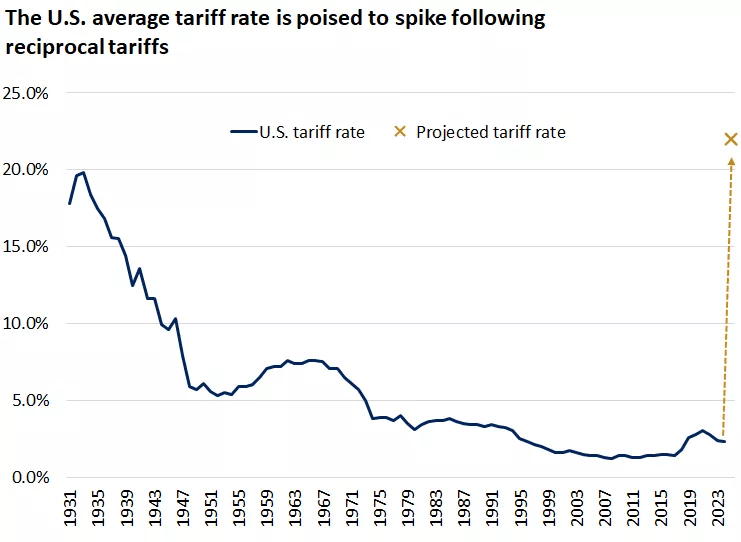

This week, US President Donald Trump’s “Liberation Day” tariff plan—unveiled April 2—set off a global trade firestorm, slamming a 10% tariff on all imports from April 5 and steeper reciprocal duties (up to 54% on China) from April 9. China’s 34% counter-tariff, effective April 10, and looming retaliation from Europe and beyond fueled a risk-off frenzy, battering markets. Here’s how key assets fared through the chaos.

Equities: Sharp Declines as Recession Fears Mount

• US Markets: The Dow Jones Industrial Average cratered 7.9% to 38,315, with a brutal 1,700-point (4%) drop Thursday—the worst day in five years—followed by futures sinking 1,150 points Friday. The S&P 500 shed 9.1% to 5,074, entering correction territory (down 10% from its February peak), while the NASDAQ plunged 10% to 15,588, marking six losing weeks in seven. Trump’s tariffs, hitting China (54%), Japan (24%), and the EU (20%), sparked fears of a $700 billion GDP hit—2.4%—pushing JPMorgan’s 2025 recession odds to 60%.

• Europe: The STOXX 600 slid 1.8% Friday, ending the week down 5%—its steepest drop since February 2022—9.1% off its peak. EU tariffs at 20% and German industrial stagnation fueled the sell-off, with banks cratering 11% in two days, the worst since March 2020.

• Equities bled as trade war risks slashed growth forecasts, with a brokerage cutting US GDP from 1.5% to 0.6% and Fitch warning of a 2025 stall.

Fixed Income: Treasury Yields Dip as Safety Reigns

• US Treasuries: The 10-year Treasury yield fell 0.3% to 3.99%—its lowest since October 2024—as bond prices rose 0.7% (YTD +3.5%). Investors fled to safety after tariffs and a tepid ISM Services PMI (50.8) stoked slowdown fears, though a robust 228,000-job NFP gain on April 4 tempered losses.

• Takeaway: Bonds rallied as tariff fallout and mixed US data (jobless claims at 219,000) hinted at Fed rate cuts—traders now eye a full point drop to 4.125% by year-end.

Commodities: Oil and Coffee Dive, Gold Shines Then Fades

• Oil: Brent crude dove 6.5% to $65.58/barrel and WTI fell 7.4% to $61.99—the lowest since 2017—after a 7% Friday crash. Tariff-driven recession fears, China’s retaliation, and OPEC+’s 411,000-barrel-per-day May boost (up from 135,000 planned) crushed prices, with Brent down 13% and WTI 14% since Wednesday. Gas prices held at $3.27/gallon nationally, up from $3.10 a month ago.

• Coffee: Arabica and robusta plunged over 3% to two-month lows, hit by risk-off sentiment and a weaker Brazilian real spurring exports. Brazil’s drought lingers, but a projected 2025/26 robusta surplus offset tight stocks.

• Gold: After surging to a record $3,158 early week on safe-haven bids, spot gold slid 2.9% to $3,045 by Friday as the dollar rallied (Dollar Index +0.4% to 102.46). Platinum dropped 0.6% to $1,022.75, silver edged up 0.3% to $34.715.

• Copper: Bucked the trend, rising 0.5% to $9,758.10/ton, lifted by China’s PMI hitting 51.2—its best since December 2024.

• Commodities split—oil and coffee sank on demand woes, gold retreated from highs, and copper held firm on Chinese strength.

Currencies: Dollar Rises, Sterling Soars, USD/CHF Crumbles

• US Dollar: The Dollar Index climbed 0.4% to 102.46, peaking at 102.75 Friday, fueled by March’s NFP surprise (228,000 jobs vs. 135,000 expected). Tariff chaos and a 4.2% unemployment tick-up tempered gains.

• Sterling: GBP soared as the UK dodged the tariff brunt, bolstered by US recession fears shifting focus.

• USD/CHF: Plummeted 2% Thursday to 0.8600—a six-month low—as investors ditched the dollar post-tariff shock. RSI signals oversold, hinting at a rebound.

• The dollar flexed on jobs data but faltered vs. safe-haven peers; sterling shone as a tariff outlier.

Cryptocurrencies: Bitcoin Slips, Altcoins Mixed

• Bitcoin: Dipped 0.3% to $83,121.50 Friday, off 0.8% from Thursday’s $83,421.50, as tariff fears curbed risk appetite. Tighter conditions and recession risks hit speculative assets.

• Altcoins: Ethereum fell 0.9% to $1,804.57, Solana dropped 2.1%, Cardano rose 0.7%, Polygon gained 1.8%. XRP edged up 0.5% to $2.0706; Dogecoin slid 1%, $TRUMP ticked up 0.5%.

• Takeaway: Crypto wobbled as investors favored gold over digital risk amid trade turmoil.

Economic Backdrop: Central Banks Brace for Impact

• US: Tariffs threaten a 4.7% inflation spike (up from 3.5% projected), prompting Fed cut bets—December at 4.125%, more in 2026. The US President pushed for swift easing, but the Fed Chair, Jerome Powell, demurred, citing tariff uncertainty and stable 2% inflation goals.

• Europe: ECB faces 20% EU tariffs, slashing growth 20 basis points. Markets see a 70% chance of a quarter-point cut this month, targeting 1.75% by year-end. France plans EU retaliation by mid-April.

• China: A 34% tariff retaliation, rare-earth export curbs, and US firm blacklists signal a deepening rift, rattling supply chains.

Source: Whitehouse.gov

Geopolitical Heat:

China halted US sorghum and poultry imports, restricted rare-earths vital for tech, and listed 27 US entities as unreliable over Taiwan arms sales. A nation’s missile-strike threat tied to US military rhetoric blurred trade and security lines, spiking volatility.

Investor Lens: Hold Steady

Diversification cushioned blows—international stocks and bonds offset US equity pain. Health care, financials, and Treasuries offer refuge; timing the market risks missing rebounds. Volatility’s here to stay as trade wars unfold.

Market Snapshot

• Dow Jones: 38,315 (-7.9% week, -9.9% YTD)

• S&P 500: 5,074 (-9.1% week, -13.7% YTD)

• NASDAQ: 15,588 (-10.0% week, -19.3% YTD)

• STOXX 600: -5% week

• Brent Crude: $65.58 (-6.5% week)

• WTI Crude: $61.99 (-7.4% week)

• Gold: $3,045 (-2.9% week)

• Bitcoin: $83,121.50 (-0.3% week)

• Dollar Index: 102.46 (+0.4% week)

• 10-yr Treasury Yield: 3.99% (-0.3% week)

Next Up

March CPI and Michigan Consumer Sentiment data this week will test inflation and confidence amid the tariff storm. Friday’s NFP (April 4) already set the tone—resilience meets stubborn uncertainty.

Source: U.S. International Trade Commission

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations