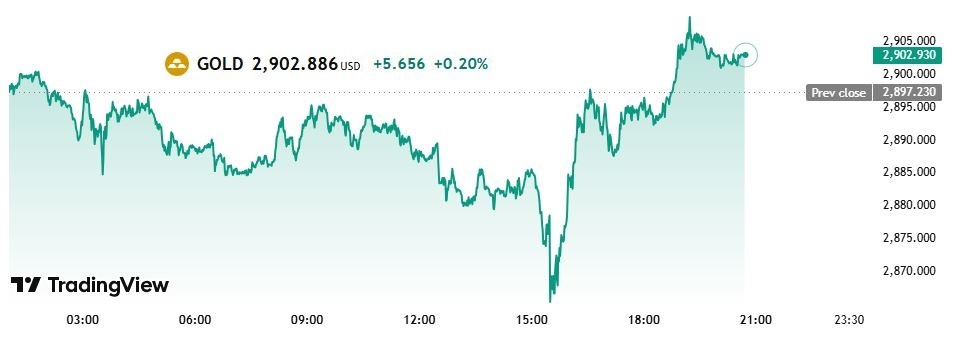

Gold prices recovered 0.20% and are trading at $2,902 per ounce after having experienced a tumultuous week, swinging from record highs to significant losses. The precious metal’s roller-coaster ride reflects the complex interplay of economic data, Federal Reserve policy, and geopolitical risks.

Gold Prices Chart – Source: TradingView

Stronger-than-expected US inflation figures triggered a midweek price drop, signaling that inflationary pressures persist. This data, coupled with Jerome Powell’s hawkish comments before Congress, reinforced expectations of continued monetary tightening. Higher interest rates and a stronger dollar create headwinds for gold, increasing the opportunity cost of holding the non-yielding asset.

Despite these pressures, gold’s earlier surge to record levels underscores the enduring appeal of safe-haven assets during times of global uncertainty. Escalating trade tensions and conflicts in the Middle East fueled demand for gold, demonstrating its role as a hedge against geopolitical risk.

Gold’s performance this week highlights the delicate balance between macroeconomic forces and global events. While inflation and the Fed’s response present challenges, geopolitical uncertainties offer support. This dynamic is likely to persist, shaping gold’s value in the foreseeable future.

Other precious and industrial metals, like platinum, silver, and copper, also saw price fluctuations, reflecting broader trends in commodity markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations