Gold continues to post record highs, extending its longest winning streak since 2020, reaching $2942 per ounce during early trading today.

Technical Outlook:

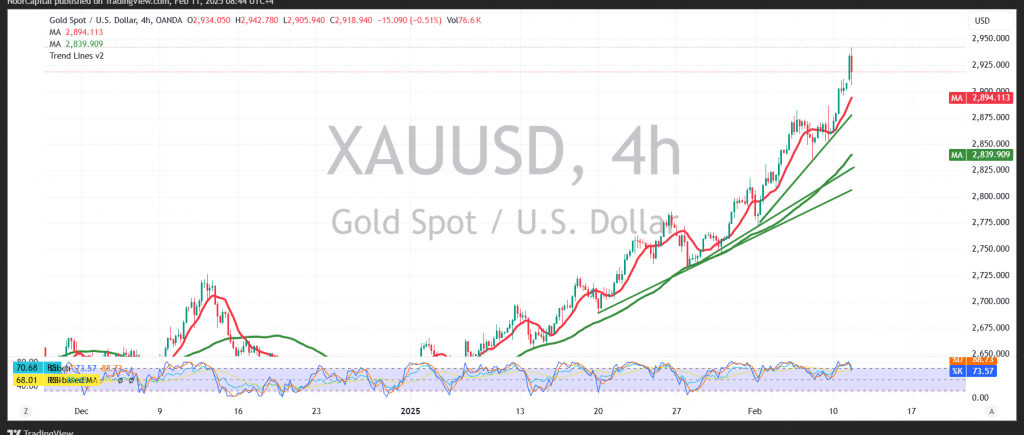

- The 4-hour chart shows that simple moving averages continue to support an upward trajectory.

- However, gold is facing resistance at $2942, aligning with the upper boundary of the ascending channel.

- The Stochastic indicator is in overbought territory, suggesting the potential for a short-term pullback.

Key Levels to Watch:

- Bullish Scenario:

- A break above $2942 would reinforce strong bullish momentum, targeting $2954 and $2975 in the near term.

- Bearish Scenario (Pullback):

- Negative signals on the Stochastic indicator may lead to a temporary dip.

- If gold retraces, it may retest support at $2878 before resuming its upward movement.

- A deeper decline could bring $2840 and $2800 into focus.

Market Risks & Considerations:

- Fed Chairman Jerome Powell’s testimony today could trigger high volatility in gold prices.

- Ongoing trade tensions and macroeconomic uncertainties further elevate risk levels.

⚠ Risk Warning: The market remains highly volatile, and all scenarios are possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations