Tariffs, Trade Diversification, and the NFP Impact

The global trade landscape is bracing for potential shifts as the specter of renewed US tariffs looms. Since 2017, even with relatively strong US economic growth, US share of global trade has been on a downward trend, while its share of global GDP and equity valuation has increased. This divergence highlights a global recalibration of trade relationships. The potential implementation of new tariffs could accelerate this trend, prompting nations to further diversify their trade partnerships. While the US market remains attractive, countries are actively seeking alternative arrangements to lessen their exposure to potential US trade barriers. The European Union, for instance, has recently finalized a trade deal with Mercosur and is pursuing agreements with other nations. China, similarly, is strengthening regional partnerships and shifting investment towards emerging markets. These actions underscore a move towards diversifying trade relationships, reducing reliance on the US market.

The impact of potential tariffs extends beyond trade flows. The mere threat has already influenced financial markets, contributing to a stronger US dollar, which poses challenges for emerging economies. Currency depreciation can fuel inflation and increase the burden of foreign debt. Central banks in some emerging markets have begun tightening monetary policy in response. The uncertainty surrounding US trade policy affects investor sentiment and business decisions, potentially impacting investment flows and economic growth. The latest Non-Farm Payroll (NFP) report adds another layer of complexity to the trade outlook. While the headline figure may fall short of expectations, strong wage growth can contribute to inflation. This may in turn trigger an aggressive monetary response by Federal Reserve, which can be detrimental to global trade.

Monetary Policy and Economic Outlook

Central banks are navigating a complex economic landscape characterized by slowing growth, persistent inflation, and global uncertainties. The Bank of England (BoE), including members of the Monetary Policy Committee, like Andrew Bailey, recently lowered its interest rate to 4.5%, while significantly downgrading its 2025 growth forecast, with inflation projected to remain above target until late 2027. This highlights the difficult balance between stimulating growth and controlling inflation.

Across the Atlantic, the Federal Reserve faces a similar dilemma. Recent statements from Federal Reserve officials emphasize the challenges of achieving price stability while maintaining economic growth. One Fed official highlighted the uneven progress on inflation, while another stressed the uncertainty introduced by trade policies. The Fed’s cautious stance suggests a data-dependent approach. Jerome Powell and other FOMC members will be closely monitoring inflation, labor market data, including the NFP report and its impact on wages, and the potential impact of trade tensions. The interaction between wage growth, inflation, and trade will be crucial in determining monetary policy

The US Dollar Index (DXY) rose 0.32% to 108.04. The US 10-year Treasury bond yield increased five basis points to 4.487%. US real yields, which typically move inversely to gold prices, rose three basis points to 2.062%. January’s Nonfarm Payrolls were 143K, below the expected 170K, and the Unemployment Rate fell to 4% from 4.1%. Money market fed funds rate futures suggest 39 basis points of easing by the Federal Reserve in 2025.

Commodities, Market Sentiment, and the NFP

Gold prices have seen upward movement amidst trade tensions. The prospect of new tariffs has bolstered gold’s safe-haven appeal. The People’s Bank of China’s (PBoC) increase in gold reserves further underscores this trend. Oil prices have also risen, driven by optimism surrounding energy demand. The NFP report plays a significant role here, as a strong labor market can imply higher economic activity, and, consequently, higher demand for oil.

Consumer sentiment, as measured by the University of Michigan’s Consumer Sentiment Index, has declined, primarily due to rising inflation fears, which are often connected to fears of trade wars. This suggests that consumers are becoming more pessimistic about the economic outlook, potentially impacting spending decisions. The increase in both short-term and long-term inflation expectations further reinforces these concerns.

Equity Markets, Corporate Performance, and German Industry

US stock index futures have steadied as investors await further economic data and assess corporate earnings reports. Amazon’s weaker-than-expected revenue outlook has dampened some enthusiasm, highlighting concerns about growth prospects in the tech sector. The slowdown in cloud growth, as seen in Amazon Web Services (AWS) results, has also raised questions about the sustainability of tech spending. These developments underscore the importance of corporate performance in shaping market sentiment.

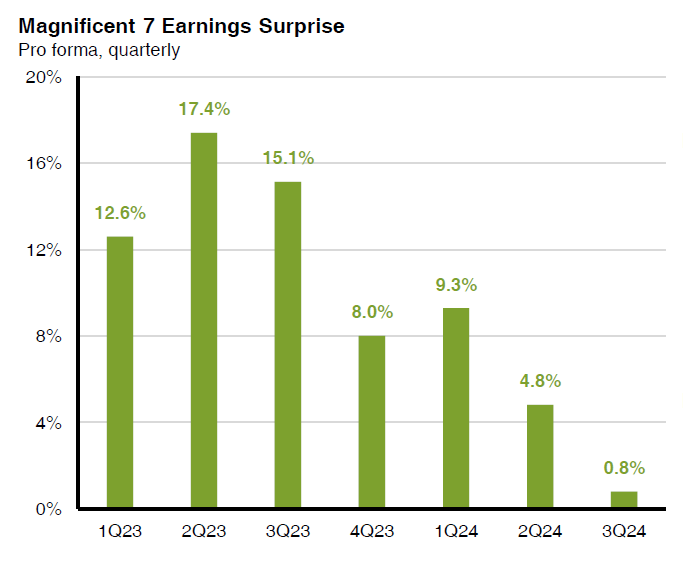

The Magnificent Seven – Source: J.. P. Morgan

The German industrial sector is facing challenges, with a significant decline in industrial production reported in December. This underscores the weakness in the manufacturing sector and raises concerns about the broader economic outlook for Germany and the Eurozone.

The Evolving Global Trade Landscape

The global trade landscape is undergoing a significant transformation. The potential for increased US tariffs has spurred other nations to diversify their trade relationships, seeking new partnerships and reducing their reliance on the US market. This shift reflects a broader trend towards regionalization and bilateral trade agreements, as countries seek to mitigate the risks associated with global uncertainties. While the US remains a critical player in global trade, its influence may be diminishing as other nations forge new alliances and trade partnerships. The NFP report and its implications for US monetary policy will be a key factor to watch as the global trade landscape evolves.

The Trading Week Ahead

The upcoming week features a busy earnings calendar, with several major companies across various sectors reporting quarterly results. Consumer giants like McDonald’s, Coca-Cola, and Shopify are all slated to release their latest figures. The technology sector will also be in focus, with reports expected from Cisco Systems and Applied Materials. Financial markets will be watching closely as Robinhood Markets unveils its performance.

Federal Reserve Chair Jerome Powell will deliver his semi-annual testimony before the Senate Banking Committee on Tuesday, providing insights into the central bank’s outlook on monetary policy. Other Fed officials, including Cleveland Fed President Beth Hammack, New York Fed President John Williams, and Fed Governor Michelle Bowman, are also scheduled to speak publicly, potentially offering further clues about the direction of interest rates and the economy.

Key economic data releases this week include the Consumer Price Index (CPI) on Wednesday, offering a fresh look at inflation trends. The Producer Price Index (PPdI) will follow on Thursday, providing further insight into price pressures at the wholesale level.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations