In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that a confirmed breach of the 2755 resistance level could lead to a new upward wave, targeting 2765, with the price reaching a high of $2766 per ounce.

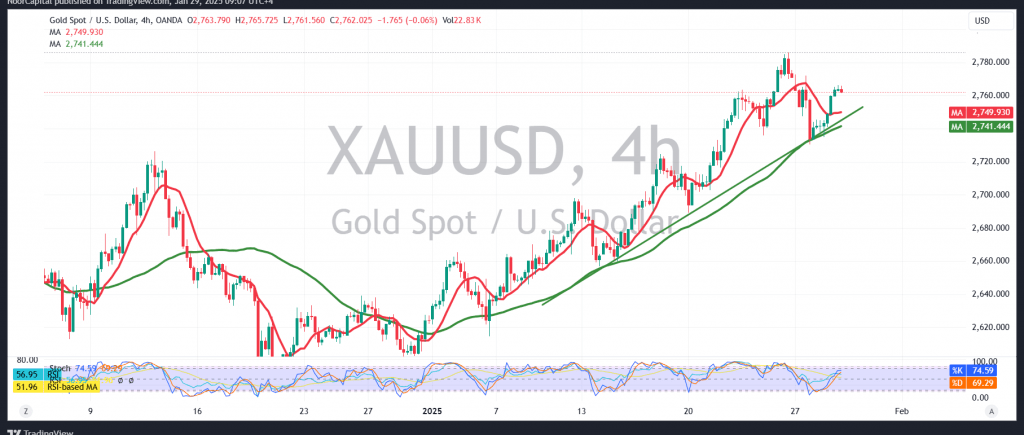

From a technical perspective today, the 4-hour chart shows the price momentarily stabilizing above 2755, while the simple moving averages support the possibility of a continued rise. However, some fluctuation may occur before a clear direction emerges due to the negative readings from the Stochastic indicator.

As a result, an upward attempt may unfold, initially targeting 2774, with a confirmed break potentially extending gains toward 2786.

On the downside, slipping below the 2742 support level could halt the bullish trend and expose the price to downside pressure, with a potential move toward 2710.

Caution: Today, high-impact economic data from the U.S. economy—including the Federal Reserve statement, Fed Chair press conference, and interest rate decision—along with Canada’s interest rate announcement and Bank of Canada monetary policy statement, could lead to significant price volatility upon release.

Risk Disclaimer: Given ongoing geopolitical tensions, all scenarios remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations