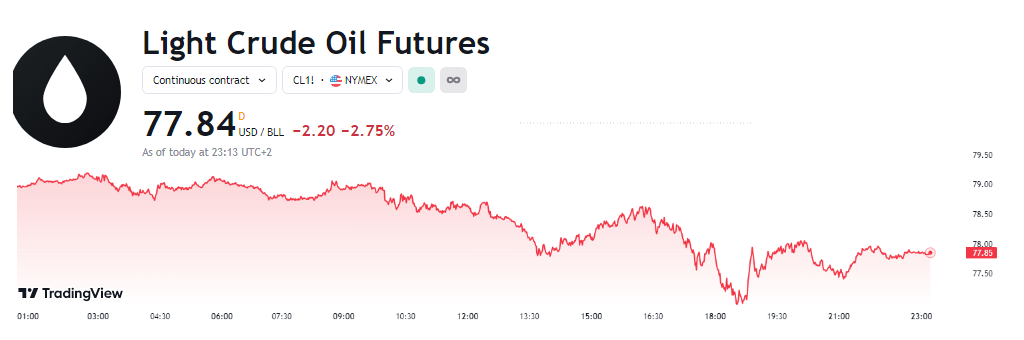

Oil prices experienced a slight decline, driven by a convergence of factors. A potential ceasefire agreement in the Red Sea, aimed at halting Houthi attacks on shipping, has eased maritime security concerns and reduced geopolitical risk premiums. This development, coupled with a recent agreement between Israel and Hamas to end hostilities in Gaza, has contributed to a more stable regional outlook. Brent crude futures settled down 74 cents, or 0.9%, at $81.29 per barrel after rising 2.6% in the previous session to their highest price since July 26. U.S. crude futures fell more than $2 at times during the North American session on Thursday.

Source: TradingView

However, strong U.S. retail sales data has injected caution into the market, raising concerns about the Federal Reserve’s monetary policy path. While some Fed officials, such as Governor Christopher Waller, have signaled a potential for earlier and faster interest rate cuts, robust economic data could complicate the central bank’s efforts to combat inflation.

The Market Remains Cautious

Despite the positive news on the geopolitical front, investors remain vigilant. The Houthi militia has emphasized the need for strict adherence to the ceasefire agreement and has reiterated its readiness to resume attacks should any violations occur. Moreover, the impact of recent U.S. sanctions on the Russian energy sector continues to reverberate, prompting Moscow to seek alternative markets for its oil exports. This has led to increased shipping costs and intensified competition for global oil supplies.

The Fed’s Tightrope Walk:

The U.S. economy continues to display resilience, with strong consumer spending driving growth. However, this economic strength poses a dilemma for the Federal Reserve. While inflationary pressures have eased somewhat, persistent price increases require a cautious approach to monetary policy.

The Road Ahead for Oil Prices:

The outlook for oil prices remains uncertain. While the potential for a more stable geopolitical environment in the Middle East could provide some support, the impact of ongoing economic uncertainty and the Fed’s policy decisions will be crucial determinants.

The International Energy Agency (IEA) recently projected that global oil demand growth will outpace supply in the coming years, potentially leading to tighter market conditions. However, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, are likely to remain cautious about increasing production, given the recent volatility in global oil markets.

The global oil market currently navigates a complex landscape. Geopolitical risks, economic uncertainty, and the evolving monetary policy landscape all contribute to price volatility. The coming months will likely witness further adjustments in oil prices as market participants grapple with these intersecting forces.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations