US stocks had a volatile week, with a sharp decline on Wednesday, followed by recovery on Friday. Volatility followed Fed’s unexpected hawkish stance during the last policy meeting in 2024. While the Fed approved a widely anticipated quarter-point interest rate cut, its projection for fewer rate cuts in 2025 than previously expected sent shockwaves through the market.

Stock indexes, including Dow Jones, plummeted by 2.6% on Wednesday, marking tenth consecutive negative trading day, a streak not seen since 1974. This decline underscores the market’s sensitivity to the Fed’s policy signals and growing concerns about the path of interest rates.

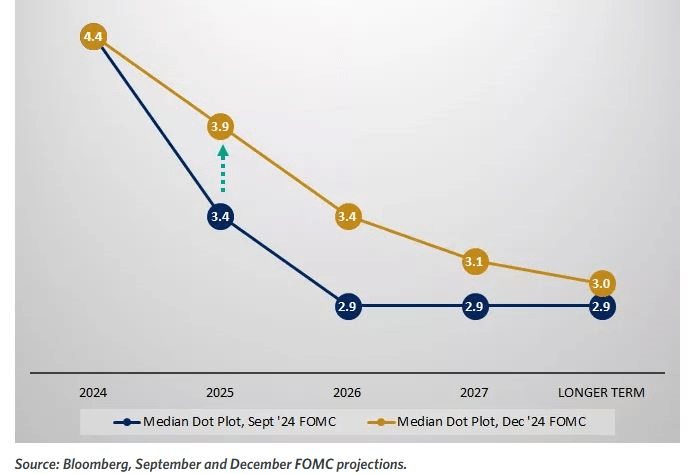

Fed exhibited a hawkish tone in its economic projections and “dot plot,” cutting rates by 0.25% to bring the fed funds rate to 4.25% – 4.5%. However, the dot plot only showed two rate cuts in 2025, below the September estimate of four. Markets initially reacted negatively, with bond yields rising and stocks dropping. The Fed cited inflation outlook and tariff policy uncertainties as reasons for its cautious approach. However, Fed Chair Powell remained optimistic about the US economy’s strength.

Bond Yields Surge, Dollar Soars

Concurrently, the bond market experienced a significant shift. Bond prices tumbled, pushing yields higher. The 10-year US Treasury yield climbed to its highest level in nearly seven months, reaching 4.59% on Thursday before retreating slightly. This surge in yields was fueled by the Fed’s more hawkish outlook, which signaled a stronger-than-expected economic growth trajectory and the potential for inflation to remain elevated.

The strengthening dollar exacerbated the market turmoil, gaining ground against major currencies, including the Japanese Yen and the British Pound. This dollar strength reflects the increased attractiveness of US assets as yields rise and the Fed maintains a more restrictive monetary policy.

PCE Data Provides Some Relief, but Dollar Momentum Persists

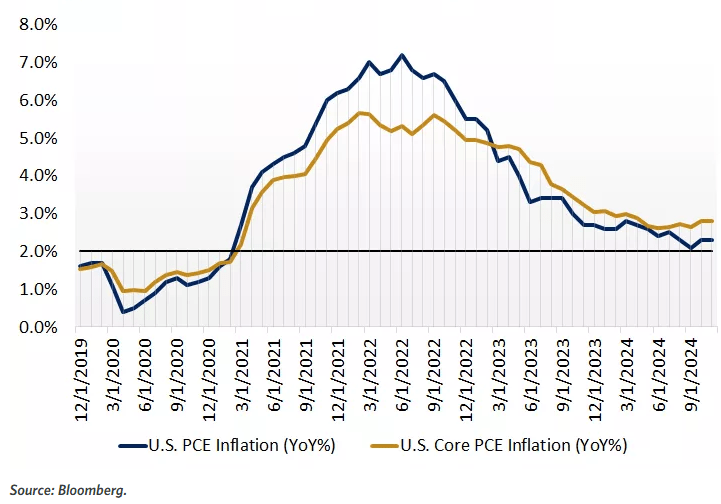

PCE data showed subdued price pressures, with goods prices rising marginally and service prices slightly increasing. Core PCE, which excludes volatile food and energy prices, rose by 0.1% monthly and 2.8% year-over-year, below expectations. This relief to concerns about persistent inflation remained intact, but the overall bullish momentum for the US Dollar remained moderated.

The USD/JPY pair retreated from multi-month highs following PCE data. Markets are also assessing political woes in the US, which soured market sentiment.

Risks of a US government shutdown have risen as House failed to pass a funding deal. Longer-term Treasury yields continue to climb, with the 10-year yield near 4.60% and the 30-year yield at 4.77%. The Fed’s hawkish signals and fewer projected cuts in 2025 continue to support the US Dollar’s relative strength.

GBP Weakened Amidst Global Market Uncertainty, Domestic Challenges

The British Pound weakened during the week, reflecting a confluence of factors. Global market uncertainty, driven by the hawkish Fed and concerns about a potential global economic slowdown, contributed to the pound’s weakness. Domestic challenges, including Bank of England’s cautious approach to monetary policy, weighed heavily on the pound’s performance. The UK economic outlook remains clouded by uncertainty, further dampening investor sentiment towards the pound.

Crypto Market Remains Volatile, Navigating Regulatory Headwinds

The cryptocurrency market remained volatile throughout the week, with Bitcoin and other major cryptocurrencies experiencing significant price swings. The market continues to be influenced by a complex interplay of factors, including regulatory developments, macroeconomic factors, and investor sentiment. Regulatory uncertainty remains a key concern, with governments worldwide grappling with how to effectively regulate the burgeoning crypto market. Additionally, macroeconomic headwinds, such as relatively high interest rates and the potential for a global recession, have also contributed to the market’s volatility. Bitcoin retreated 1.45%, trading at $95,800.

XAU/USD Struggles Amid Higher Yields and Dollar Strength

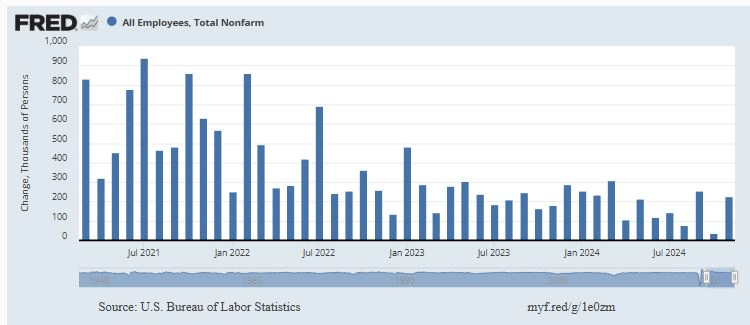

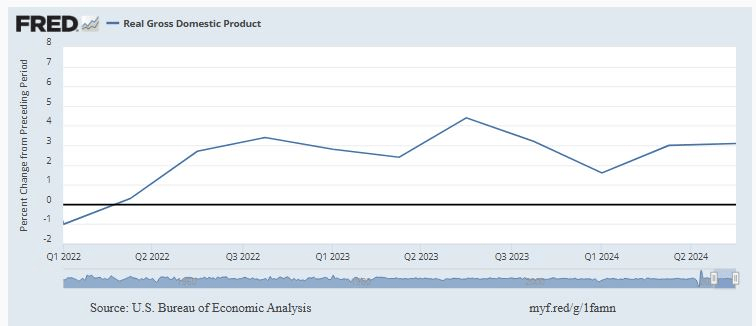

Gold prices experienced a sharp sell-off earlier during the previous trading week due to higher US yields and a strong dollar. Gold, traditionally viewed as a safe-haven asset, loses its luster when interest rates bets and the dollar strengthens. Although cooler-than-expected PCE data provided some support for gold, it remained under pressure. XAU/USD was trading with a moderate positive tone on Friday following the sharp sell-off earlier on the week. PCE Inflation increased 0.1% in November, against expectations of a 0.2% increment. The yearly rate accelerated to 2.4% from the previous month’s 2.3% reading, still below the 2.5% anticipated by the market consensus. The Core PCE eased to 0.1% from 0.3% in October, while the yearly inflation remained steady at 2.8% against market expectations of an uptick to 2.9%. On Thursday, an upward revision to the third quarter’s US Gross Domestic Product (GDP) and lower-than-expected Jobless claims endorsed the Fed’s hawkish stance for 2025.

Gold is going through a corrective recovery from heavily oversold levels, but the broader trend remains bearish.

The Gold Index is struggling to find acceptance above $2,600, with immediate resistance at the $2,605 intra-day high and key resistance areas at the $2,625-$2,630 area. Supports are at Wednesday’s low at around $2,580, ahead of November’s trough at $2,540.

Oil Prices Range-bound Amidst Fed Hawkishness and Economic Concerns

Crude oil prices remained range-bound, facing headwinds from the Fed’s hawkish rhetoric and concerns about a potential economic slowdown. The Fed’s tightening monetary policy could dampen economic growth and reduce demand for oil. Additionally, concerns about a global recession and the potential impact on energy consumption weighed heavily on oil prices. The US oil rig count saw a slight increase, according to Baker Hughes data, indicating continued activity in the US oil and gas sector. WTI lost 2.77% and traded at $69.46 per barrel and Brent crude oil likewise retreated to roughly $72.04 per barrel during the latest North American session.

Market Outlook: Navigating Volatility and Uncertainty

The recent market volatility highlights the uncertainty in the market due to the Fed’s hawkish stance, inflation concerns, and potential global economic slowdown. Investors must adopt a disciplined approach, long-term investment horizon, and diversification. The Fed’s slower rate cut indicates a focus on economic growth and managing inflation risks. However, the path forward remains uncertain, and investors should be prepared for potential market fluctuations.

The Week Ahead:

This week’s key economic reports include the October domestic GDP and the US consumer confidence survey. Investors are hoping for some festive happiness at the end of 2024, but they are also cautioning about possible challenges, as December has so far produced satisfactory returns in an otherwise excellent year for US stocks.

Despite a significant setback this week, the benchmark S&P 500 is up more than 24% for 2024, and Wall Street has historically had a good annual close.

Known as the “Santa Claus Rally,” reports indicate that since 1969, the final five trading days of the year plus the first two of the following year have produced an average 1.3% gain for the S&P 500.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations