The US stock market experienced a significant rally on Friday, fueled by a cooler-than-expected inflation report. This positive news provided a much-needed respite for investors grappling with the looming threat of a government shutdown and recent uncertainty surrounding the Federal Reserve’s monetary policy.

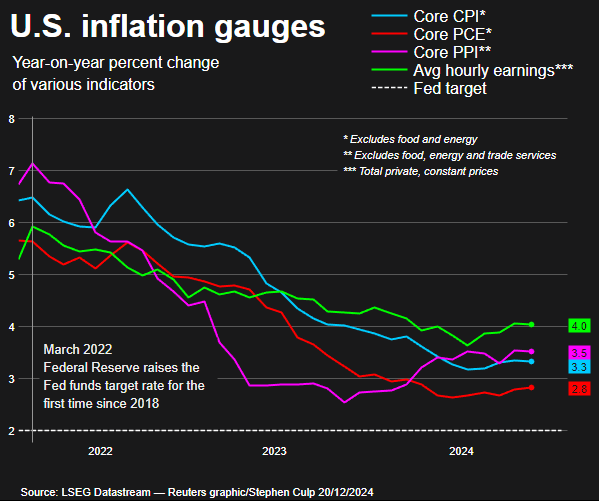

The Commerce Department’s report revealed that the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, increased at a slower-than-expected pace. This data reinforces the narrative that inflation is gradually moderating, moving closer to the Fed’s 2% target. This development calmed investor fears and encouraged a risk-on sentiment.

The Fed’s recent decision to slow the pace of interest rate hikes had initially rattled markets. While acknowledging the need for continued rate increases, the Fed signaled a potential shift towards a less aggressive monetary policy stance. This announcement, coupled with the ongoing political deadlock in Washington over the debt ceiling, had created a backdrop of uncertainty for investors.

However, the cooling inflation data significantly shifted market sentiment. Treasury yields, which had been on the rise, eased back, indicating a decline in investor expectations for future rate hikes. This, in turn, boosted investor confidence and fueled the rally in equity markets.

The S&P 500 and the Nasdaq experienced significant gains, recovering some of the losses incurred during the week. The Dow Jones Industrial Average also saw substantial growth, ending the day with a strong positive performance.

Despite this positive turn, the broader global market picture remains mixed. European stocks continued to face headwinds, largely due to concerns stemming from potential trade tariffs on the European Union. Emerging markets also experienced weakness, reflecting broader global economic uncertainties.

Looking Ahead:

The cooling inflation data offers a glimmer of hope for investors and policymakers alike. It suggests that the Fed’s efforts to combat inflation are gradually yielding results. However, the road ahead remains challenging.

The potential for a government shutdown remains a significant threat to economic stability. A resolution to this impasse is crucial to restore investor confidence and prevent further economic disruptions.

Furthermore, the Fed’s path forward on monetary policy remains delicate. While the recent data provides some room for optimism, the central bank must carefully navigate the risk of both persistent inflation and a potential economic slowdown.

The global economic landscape also presents its own set of challenges. Trade tensions and geopolitical uncertainties continue to weigh on investor sentiment.

Despite these challenges, the cooling inflation data provides a much-needed boost to investor confidence. It underscores the importance of vigilant monetary policy and emphasizes the need for a stable and predictable economic environment.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations