Gold prices followed the expected upward trend outlined in the previous technical report, where the stability of trading above the 2678 support level was highlighted. However, as noted, breaking the 2670 support level would halt the bullish scenario, placing gold under negative pressure. This scenario materialized, with prices reaching a low of $2643 per ounce.

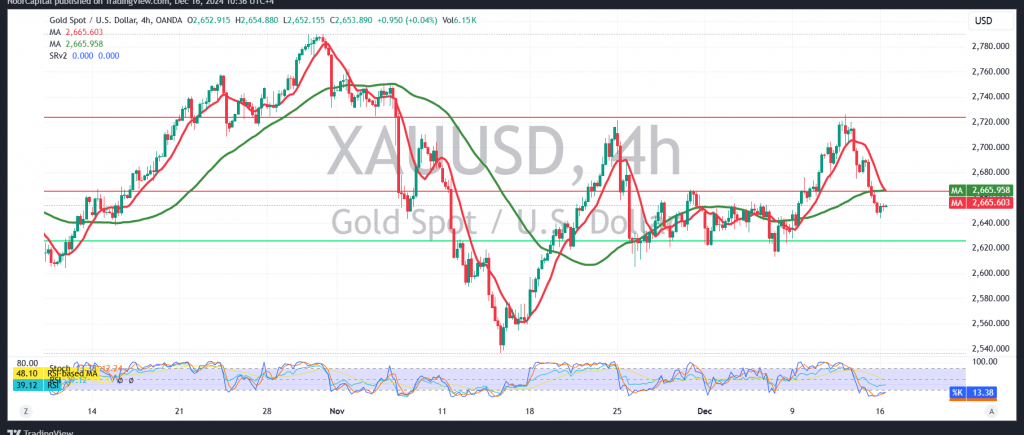

From a technical perspective today, a closer analysis of the 4-hour chart reveals continued negative pressure from the simple moving averages, along with trading stability below the ascending trend line.

With trading remaining below 2680, and more importantly below 2683, the bearish trend remains the most probable scenario. A confirmed break of 2640 would pave the way for a decline towards 2634 as the initial target, followed by 2615 as the next key level.

Conversely, a move above 2683 would invalidate the bearish outlook, with gold resuming its upward trajectory. In this case, targets would start at 2712 and extend to 2732.

Warning: High risks persist, and they may not align with the expected returns.

Warning: Given ongoing geopolitical tensions, market volatility is elevated, and all scenarios remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations