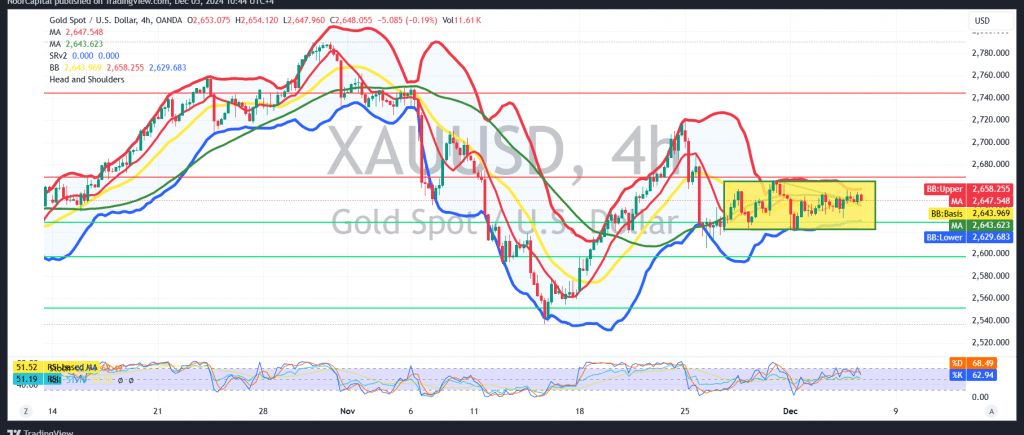

Gold continues to exhibit a sideways trend, trading within a narrow range confined between the support level at 2635 and resistance level at 2657 for several consecutive sessions.

Technical Analysis:

- Positive Signals: The 50-day simple moving average provides upward pressure, hinting at the possibility of a bullish breakout.

- Negative Signals: The Stochastic indicator continues to display bearish momentum, contributing to the prevailing technical conflict.

Scenario Analysis:

- Bullish Case:

A confirmed breakout above the pivotal resistance zone of 2658–2660 could signal a return to the upward path. Initial targets include 2670 and 2684, with a potential extension toward 2700 if momentum persists. - Bearish Case:

A confirmed break below 2637 would favor a corrective decline, targeting 2610 as the first milestone, followed by 2600 as the next significant support.

Key Considerations:

Risk Warning:

The risk level is elevated due to ongoing geopolitical tensions, making all scenarios possible. Adjust trading strategies accordingly.

High-Impact Economic Events:

Today’s release of U.S. “Weekly Unemployment Claims” data could introduce significant volatility to the gold market.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations