Gold prices faced significant selling pressure during the previous trading session, aligning with our anticipated bearish outlook. The metal reached the official target of the ongoing downtrend at $2589 per ounce, marking its lowest point at $2589.

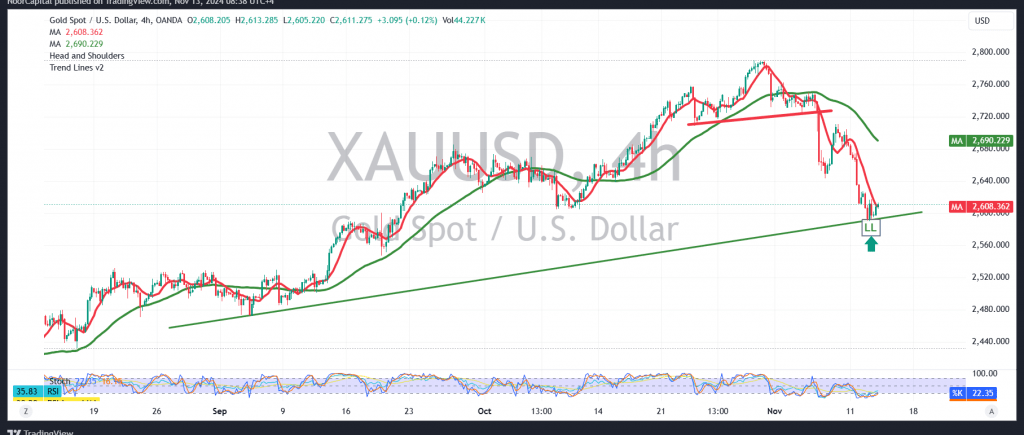

On the technical side, gold has established a solid support base around $2589, a level reinforced by the main upward trend line. Current price action shows stability above the critical psychological barrier of $2600. A closer look at the 4-hour chart indicates the Stochastic oscillator is attempting to generate positive signals, suggesting the possibility of a limited upward correction.

In today’s session, we may see recovery attempts, with $2630 as the initial target. A breakout above this level could strengthen the prospects for a continued upward move toward $2647.

However, it is crucial to emphasize that this optimistic scenario is contingent on gold maintaining daily trading above $2600. Should prices break below this support, the downtrend is likely to resume, with targets at $2571 and $2553, respectively.

Caution: Today’s high-impact economic data from the US, specifically the “Consumer Price Index – Annual and Monthly,” could trigger significant price volatility upon release.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, making various scenarios plausible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations