Gold prices have continued their historic climb, reaching $2790 per ounce after surpassing the previous peak of $2758.

Technical Analysis:

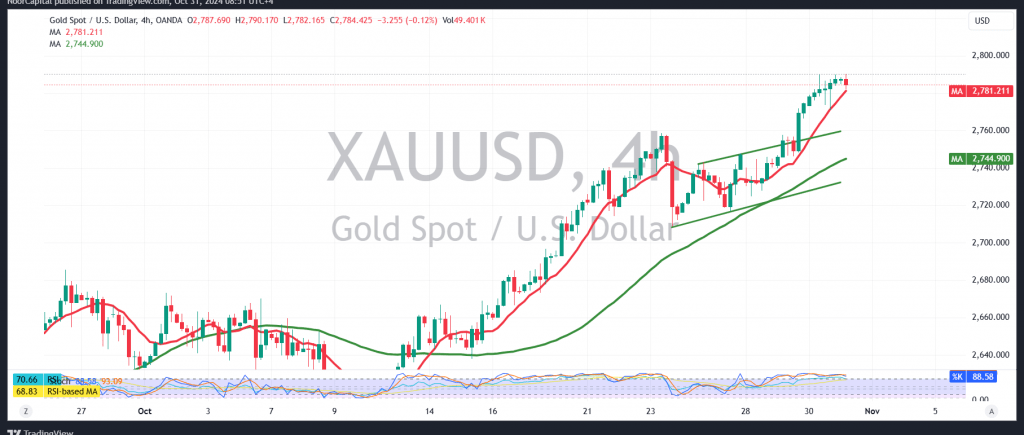

- The 4-hour chart shows that simple moving averages continue to support the upward momentum, while the momentum indicator remains strong above the 50 midline, indicating a sustained bullish outlook.

- For the upward trend to continue, trading stability above $2790 is essential, which would likely accelerate gains, targeting $2800 initially, and potentially extending to $2810 and $2830.

- However, if the $2790 level fails to hold and trading stabilizes below $2772, a corrective decline could be in play, with an initial target around $2758, now acting as a support level after its previous breakout.

Warnings:

- Anticipated high-impact economic data from the US today, including Core Personal Consumption Expenditure Prices, Unemployment Benefits, and the Employment Cost Index, may lead to heightened price volatility during the news release.

- Amid ongoing geopolitical tensions, the risk level is high, and diverse outcomes remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations