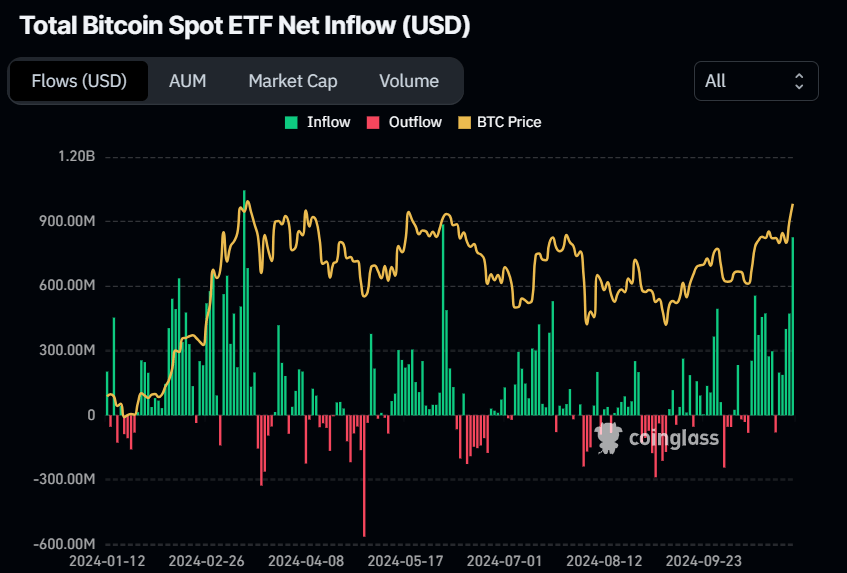

Bitcoin (BTC) has been on a remarkable upward trajectory, flirting with new all-time highs. On Tuesday, it reached a peak of $73,620, fueled by strong institutional demand, particularly from US spot Bitcoin ETFs. These ETFs saw a significant inflow of $827 million, the third-largest single-day inflow since their launch.

Analysts believe that any dip below the $70,000 level is likely to attract strong buying support, especially ahead of the US presidential election. This sentiment is further bolstered by the increasing interest from traditional financial institutions, such as Emory University’s recent $15 million investment in the Grayscale Bitcoin Mini Trust.

While the bullish momentum is strong, it’s important to note that some market participants, like the Government of Bhutan, may take advantage of the high prices to sell a portion of their holdings. However, the overall trend remains positive, with many analysts predicting that Bitcoin could break its all-time high and reach even higher levels.

As Bitcoin continues to gain traction and institutional acceptance, its price is likely to remain volatile. Traders should exercise caution and consider risk management strategies to protect their investments.

Massive inflows into spot Bitcoin exchange-traded funds (ETFs), optimism surrounding the approaching US elections, and a number of technical and onchain indications all point to the price of Bitcoin rising. Bitcoin is headed for new all-time highs, with a ticker down at $72,009.

The price of Bitcoin could reach $100,000 if Trump wins.

Some market analysts have dubbed Bitcoin’s recent surge above $73,000 the “Trump trade,” as cryptocurrency fans grow increasingly optimistic about a possible Trump administration.

In betting markets, former President Donald Trump and Republican presidential contender Kamala Harris continue to lag behind him.

Among other statements, Trump has been courting the cryptocurrency business by portraying himself as a candidate who is supportive of the industry, attending the Bitcoin Conference in Nashville in July, and vowing never to sell any Bitcoin owned by the US government.

Harris’ stance on cryptocurrency, on the other hand, is still up in the air, though some believe she will adopt a more moderate stance than Joe Biden.

According to data from Polymarket, Trump has a 67% chance of winning the Nov. 5 presidential election, compared to 33% for Democratic contender Kamala Harris. Opinion surveys, however, indicate that the election will be too close to call.

The market is becoming more optimistic about a potential Trump victory. Some teen Bitcoin billionaires, believes that if Trump wins, the US would become more pro-crypto and the crypto markets will see a huge rush of investment.

Those teen Bitcoin billionaires went on to say, “His policies will ignite the crypto market, fueling massive growth across the board.”

“I think Bitcoin could reach $100,000 during Trump’s second term if he wins.”

Market expert Tony Sycamore of IG Australia Pty thinks that Bitcoin’s trajectory shows a positive prognosis for Trump, emphasizing the significance of maintaining its position above $70,000 to foster confidence in the rise that may surpass the peak of $73,794 in March.

The price of bitcoin has increased by about 15% in October, giving the “Uptober” story some traction.

Return of large spot inflows into Bitcoin ETFs

Since they started trading on January 11, spot Bitcoin ETFs have seen a huge influx of cash, with data from Farside Investors indicating that $23.3 billion has been invested in these financial instruments.

Although there are still outflows from Grayscale’s GBTC, they are more than offset by inflows into other ETFs, such as BlackRock’s IBIT, which saw inflows of $642.9 million, marking the largest trading day in six months.

This week saw a spike in demand for Bitcoin ETFs, with inflows totaling $2.1 billion over the previous five days. Over $870 million was invested in spot Bitcoin ETFs on October 30 alone. According to analysts, they are the “strongest ETF inflows” since March.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations