Global financial markets closed the week ending on Friday, October 11, with risk assets advancing over safe haven assets after US inflation data that highlighted a decline in price growth that would weigh heavily on interest rate cuts in the coming period. Markets are also awaiting developments in monetary policy next week, as the European Central Bank is expected to issue its interest rate decision.

Global stocks rose, led by US and European stocks, which benefited greatly from the improvement in risk appetite in the markets following the inflation data that shed more light on the future path of the Federal Reserve’s monetary policy.

The Eurozone witnessed other positive developments in terms of data in Germany, the largest economy in the Eurozone, in addition to other developments in terms of the European Central Bank’s monetary policy, in addition to developments in terms of the Chinese stimulus package, the details of which were announced last week.

Gold was also able to surge on the shoulders of the US dollar, which continued to suffer throughout the past week after expectations emerged in the markets that the currency was close to exiting the high-yielding asset group.

Economic data

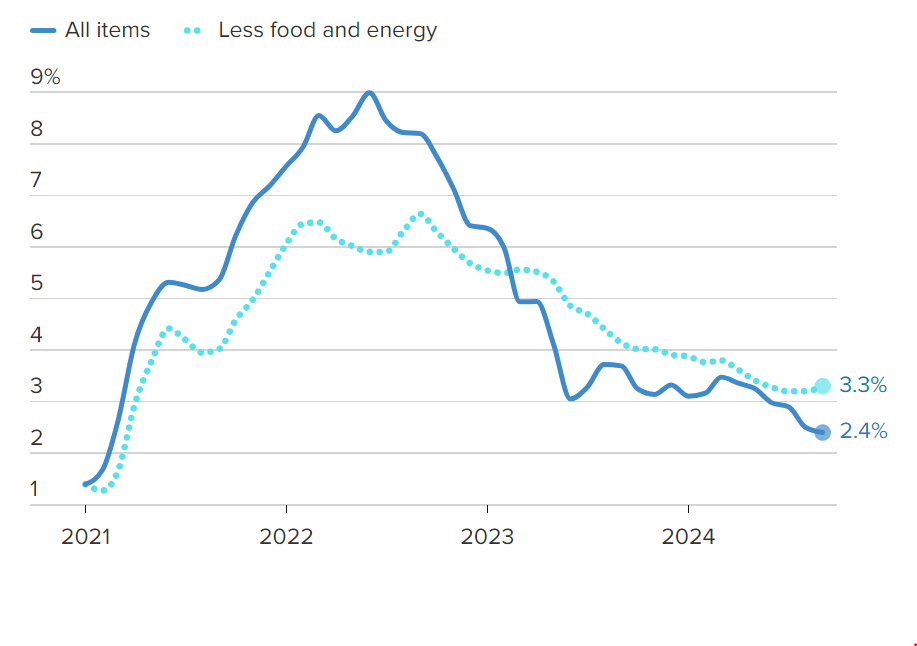

The US Consumer Price Index (CPI) rose 0.2% on a monthly basis in September, compared to the same reading in the previous month, slightly above market expectations of 0.1%, according to the US Bureau of Labor Statistics published last Thursday.

The annual reading of the index rose 2.4% in September, compared to the previous month’s reading of 2.5%, which also exceeded market expectations of only 2.3%.

Excluding food and energy prices, the monthly reading of the index rose 0.3%, indicating no change compared to the previous reading, but it was higher than expectations of a 0.2% increase.

The annual reading, which excludes the most volatile price components, rose 3.3% in September, indicating a higher reading than its previous reading recorded in August at 3.2%. Expectations had indicated that the reading might not witness any change.

The data released on Friday highlighted that inflation in the United States may show further decline in the coming period.

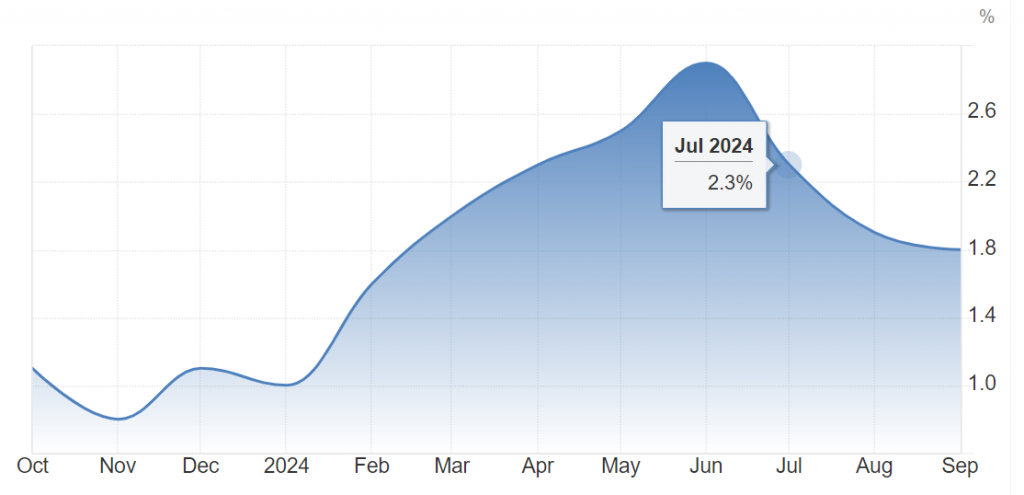

US producer price data highlighted a decline in prices to 0.0% in September compared to the previous month’s reading of 0.2%, which was lower than market expectations of 0.1%.

Meanwhile, the annual reading of the index rose by about 1.8% compared to the reading recorded in the same month last year at 1.9%.

Excluding food and energy prices, the monthly reading of producer prices recorded 0.2% compared to the previous reading recorded in August at 0.3%, which was in line with market expectations.

The annual reading, which takes into account the most volatile components of prices, rose to 2.8% compared to the previous reading of 2.6%, which exceeded market expectations of 2.7%.

US Dollar and Gold

The US dollar declined significantly throughout last week’s trading, affected by US inflation data, which highlighted a decline in price growth levels in the United States. Although US consumer prices came in higher than market expectations, they came in lower in September than the previous month’s readings.

The dollar index, which measures the performance of the US currency against a basket of US currencies, rose to 102.92 points, compared to last week’s closing of 102.52 points. The index reached its lowest point over the past week at 102.34 points, compared to its highest level of 103.11. The index could have achieved further increases, but its rise was limited by US inflation data.

In contrast, gold benefited from the limited rise in the US currency, but this rise was also limited by the confusion caused by the first batch of US consumer price inflation data, which recorded readings higher than market expectations despite recording a decline in September compared to the previous month’s reading. Despite exceeding market expectations, US consumer price readings in September came in lower than the previous month’s readings, which led to a significant decline in expectations for a rate cut – 0.5% – which is unlikely to be favored by the bulls of the US dollar and its assets.

On the other hand, this data came in higher than market expectations, which caused confusion in the movement of the US dollar and the precious metal, so some people thought that these two assets did not witness any change at the end of last trading week.

Euro and European stocks

In contrast to European stocks, the euro ended last week’s trading in a downward direction despite the positivity that European assets enjoyed throughout that period for reasons related to monetary policy.

European stock markets benefited from optimism about further decline in inflation in the United States at the level of consumers and producers alike, which bodes well for the Federal Reserve’s approach to normalizing monetary policy, or what can be defined as bringing interest rates to normal levels.

European indices also rose with a boost from data that appeared last week, which highlighted an improvement in retail sales levels in Germany, the largest economy in the eurozone, for four consecutive months.

The reading of the industrial production index in Germany, the largest economy in the eurozone, rose to levels that exceeded market expectations in August after the index recorded an increase to 2.9% compared to the reading recorded the previous month at 2.4%.

The automotive manufacturing sector, one of the most important components of European industrial production, achieved growth of about 19.3%, while the capital goods sector in the region achieved growth of about 6.9% at the level of sector output, according to data issued by the Federal Statistical Office in Germany.

The spread between the yields of the benchmark US Treasury bonds and German government bonds – the benchmark of the European Monetary Union – also widened, which is in favor of the US currency at the expense of the euro.

This spread widened due to expectations that the European Central Bank could cut interest rates twice in the next two meetings of the Monetary Policy Committee.

Yen and Yentervention

The story of the Japanese yen was different in the week ending October 11, as news spread in the markets about the government in Tokyo intervening in the exchange rate in order to support the currency. For this reason, the yen rose at various times last week.

But the currency eventually succumbed to the pressure of the US dollar, as the dollar/yen pair ended last week’s trading in an upward direction at 149.00 compared to the closing recorded at the end of the previous week at 148.65.

Japanese Finance Minister Katsunobu Kato confirmed last week that sudden movements in the currency negatively affect Japanese companies and households and that the government in Tokyo is closely monitoring these fluctuations. Markets interpreted these statements as an official hint by the government in Tokyo of the possibility of intervening to support the Japanese currency.

Reports in April and May indicated that the Japanese government may have intervened in the exchange rate in order to support the local currency, whose decline has reached the point of harming all economic sectors in the country.

In late April, the Japanese yen was subjected to severe pressure since the beginning of trading in the new trading week, affected by the Bank of Japan keeping the interest rate unchanged at its meeting that month.

The pressure on the currency was also increased by the central bank’s speech, which avoided showing enough inclination to raise interest rates to higher levels in the coming period, so that it stabilized for a period that may be extended at 0.0%.

The Bank of Japan also announced at the time that it would buy 600 trillion yen worth of government bonds, which caused dismay among those who expected a change in the size of the asset purchases.

The Japanese Ministry of Finance often intervenes in the exchange rate without officially announcing the move, so the widespread speculation of intervention in the headlines is a sign that it has already happened. And it has happened – the profusion of speculation of intervention in the Japanese exchange rate in the headlines – which suggests that it may have happened.

Cryptocurrencies

The past week has been a negative one for cryptocurrencies, leading to a weekly closing in a bearish trend for Bitcoin and most cryptocurrencies. Here is a review of the most significant negative developments that have dominated the digital asset markets during this period.

The negative news included Binance’s announcement that it would delist four cryptocurrency pairs from its platform; They are APE/ETH, ATOM/BNB, BAL/BTC, and BNB/DAI. The Australian Financial Services Board has also investigated the monopoly practices of Upbit in the cryptocurrency sector in South Korea.

Next week

Over the next week, there are a number of important events that will affect the price movement of assets traded in the financial markets over the next five trading days. The European Central Bank’s interest rate decision is at the forefront of these events, amid expectations that it will cut interest rates in the next meeting and the meeting that follows it by 25 basis points each.

In terms of data, US retail sales are at the forefront of the economic calendar next week. The importance of this batch of data increases in that it may confirm to the markets the possibility of seeing inflation decline further in the coming period, as it provides a clear picture of consumer spending, which is strongly linked to the rate of demand, which in turn is linked to price growth, or rather inflation.

Financial and technology giants are also releasing their third-quarter earnings reports, most notably Citigroup, the major financial group, Goldman Sachs, and Morgan Stanley. Companies from other sectors are also releasing their earnings reports, most notably Taiwan Semiconductor and Johnson & Johnson.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations