The USD/JPY pair has been rising since the start of the American trading session in the currency market, driven by the increase in US Treasury yields. This is due to the positive relationship between the pair and the yields on these government bonds, highlighting the weakness of the Japanese yen.

US Treasury yields have continued to rise since the start of daily trading, driven by data highlighting improvements in key economic sectors in the country, as well as statements from the Federal Reserve on Monday suggesting a slower pace in cutting interest rates in the upcoming period.

The US Dollar Index, which provides a clear picture of the performance of the US dollar against a basket of major currencies, rose to 100.56 points compared to last Friday’s close at 100.38 points. The index recorded its lowest level on the first trading day of the new week at 100.18 points, compared to the highest level of 100.67 points. The yield on 10-year US Treasury bonds rose to 3.770% compared to the previous daily close of 3.754%. The yields fell to their lowest level on Monday’s trading day at 3.751% compared to the highest level of 3.798%.

The Chicago Purchasing Managers’ Index unexpectedly rose by 0.5% to 46.6 points, which was higher than market expectations that predicted a decline of 0.1% to 46.00 points.

The Dallas Fed Manufacturing Index reading for September rose by 0.7% to its highest level in 20 months at -9.00 points, exceeding market expectations that suggested the reading would stop at -10.8 points.

Federal Reserve Board member Michelle W. Bowman said on Monday that inflation, excluding food and energy prices, remains at “uncomfortable” levels above the central bank’s official target. The US dollar also received support from the readings of the Chicago Purchasing Managers’ Index and the Dallas Fed Manufacturing Index.

Bank of Japan

The USD/JPY pair rose to 142.96 compared to the previous daily close of 142.15. The pair fell to its lowest level on the first trading day of the new week at 141.64 compared to the highest level of 143.36.

The Japanese yen received a boost from political developments in Japan on Monday, but it quickly lost its upward momentum. Last Friday’s headlines were dominated by political developments, including the victory of former Defense Minister Shigeru Ishiba in the Liberal Democratic Party leadership race. Ishiba, a proponent of gradually raising interest rates by the Bank of Japan, defeated a strong opponent of Japanese interest rate hikes, Sanae Takaichi.

Japanese interest rate expectations indicate a 5.00% chance that the Bank of Japan will raise interest rates by 10 basis points at its meeting on October 30-31, compared to a 23% chance of a 10 basis point hike at the central bank’s December meeting.

Political Developments

The Japanese yen managed to recover its daily losses last Friday following the announcement of Shigeru Ishiba, former Defense Minister, in the Liberal Democratic Party’s internal elections to become Japan’s new Prime Minister. These political developments provided support for the yen, although some traders remain cautious about the Bank of Japan’s stance on future interest rate hikes.

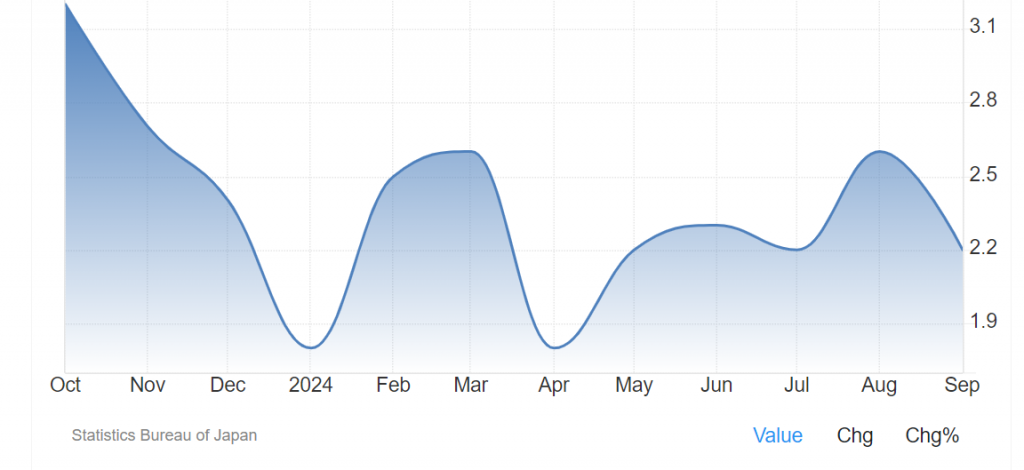

The Tokyo Consumer Price Index rose by 2.2% year-on-year in September, slowing from the 2.6% increase in August. Meanwhile, the index, excluding fresh food and energy, rose by 1.6% year-on-year, unchanged from the previous reading. At the same time, the index, excluding fresh food, rose by 2.0% as expected, compared to the previous increase of 2.4%. These figures suggest that inflationary pressures in Japan may ease slightly, but they remain a focal point for monetary policymakers.

Earlier this month, Bank of Japan board member Junko Nakagawa made statements reflecting a strong will within the central bank to raise interest rates. She emphasized that the path taken by the Federal Reserve last month might not deter the central bank from its plan to raise rates.

However, she also stressed that the Bank of Japan should consider the impact this move could have on the economic outlook and prices when studying the decision to cut rates.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations