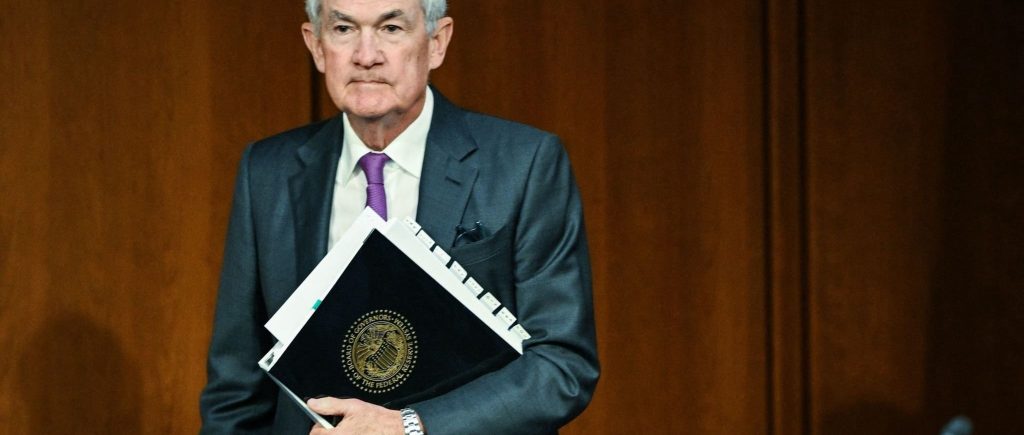

Fed Chair Jerome Powell reiterated that inflation has been broadly defeated and that recent data indicate further progress toward a sustained return to 2% core goods prices have fallen a half percent over the past year, close to their pre-pandemic pace, as supply bottlenecks have eased outside of housing services.

In terms of the services sector, Powell stated that inflation is also close to its pre-pandemic pace. As for Housing Services, inflation continued, continues to decline, but sluggishly. The surge in rents charged to new tenants remains low. As long as that remains the case, housing services, inflation will continue to decline. Broader economic conditions also set the table for further disinflation.

Powell stressed that the labour market is now roughly in balance. Longer run, inflation expectations remain well anchored. Turning to monetary policy, over the past year, we have continued to see solid growth and healthy gains in the labor force and in productivity. Our goal all along has been to restore price stability without a kind of painful rise in unemployment that has frequently accompanied efforts to bring down high inflation. That would be a highly desirable result for the communities, families and businesses we serve.

Powell added: “While that task is not complete, we have made a good deal of progress toward that outcome for much of the past three years, inflation ran well above our goal, and the labor market was extremely tight. Appropriately, our focus was on bringing down inflation. by keeping monetary policy restrictive, we helped restore the balance between overall supply and demand in the economy.”.

Powell praised the Fed’s patient approach, which has paid dividends. He stressed that inflation is now much closer to our 2% objective. Today, we see the risks to achieving our employment and inflation goals as roughly in balance, our policy rate had been at a two decade high since the July 2023 meeting at the time of that meeting, core inflation was 4.2% well above our target, and unemployment was 3.5% near a 50 year low.

According to the Fed’s Chair, in the 14 months since the July 2023 meeting, inflation has moved down and unemployment has moved up. In both cases significantly, it was time for recalibration of our policy stance to reflect progress toward our goals as well as the changed balance of risks.

Powell also said: “As I mentioned, our decision to reduce our policy rate by 50 basis points reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate economic growth and inflation moving down sustainably to 2% looking forward, if the economy evolves broadly as expected, policy will move, over time, toward a more neutral stance. But we are not on any preset course.”.

He warned that the risks are two sided, and the Fed will continue to make its decisions, meeting by meeting. As policymakers consider additional policy adjustments, they will carefully assess incoming data, evolving, the evolving outlook in the balance of risks, and overall, the economy is in solid shape.

According to Powell, policymakers intend to use our tools to keep it there. We remain resolute in our commitment to our maximum employment and price stability mandates, and everything we do is in service to our public mission.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations