Monday saw a temporary extension of the euro’s slide versus the US dollar as business activity figures for the euro zone economy disappointed. Prior to this, US statistics had indicated that activity remained stable. With markets already putting in a roughly 77% possibility for a cut of at least 25 basis points (bps) at the central bank’s October meeting, the soft Eurozone data encouraged expectations for more interest rate cuts by the European Central Bank this year.

According to a poll conducted by S&P Global, the Eurozone’s business activity fell precipitously this month as the region’s leading services sector stagnated and manufacturing declined more quickly. The contractions were widespread, with France returning to contraction after August’s lift from the Olympic Games and Germany’s downturn intensifying. While US economic activity remained stable in September, average prices for goods and services increased at the highest rate in six months, potentially signaling an impending spike in inflation.

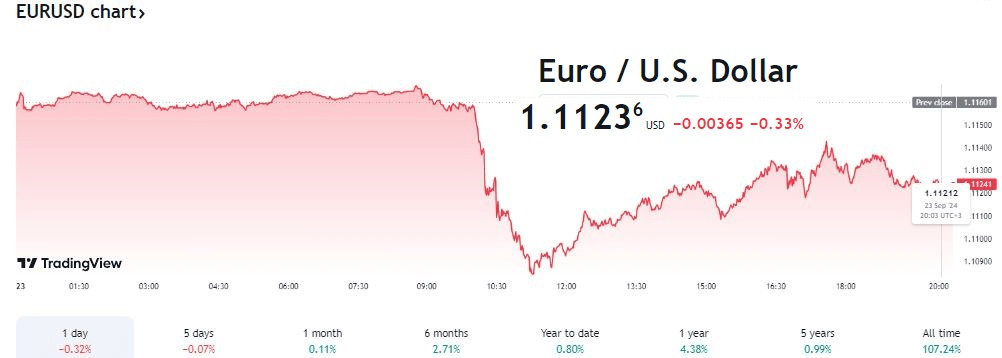

According to S&P Global, the manufacturing and services sectors are tracked by the flash US Composite PMI Output Index, which was slightly changed this month at 54.4 from a final result of 54.6 in August. A reading above 50 indicates expansion. After peaking at 101.23 during the session, the dollar index—which measures its performance against a basket of currencies, including the yen and the euro—rose 0.04% to 100.82. At $1.1131, the euro was down 0.28% and headed for its largest daily loss since September 9.

The main focus of economists is interest rate expectations; traditionally, it has been realistic to assume that the Fed will take the lead and be somewhat more aggressive when it comes to interest rate cuts. The US dollar is likely to benefit the market in some way from anything that would push prices closer to where the Fed is. Following the Fed’s larger-than-usual 50 basis point reduction in interest rates last week, the dollar declined for a third consecutive week. In their remarks on Monday, a number of Fed officials stated that the recent rate reduction was the “right decision”. “Many more rate cuts over the next year,” said a few more officials.

The Fed is not in a “mad dash” to a neutral rate of interest as policymakers debate how far and fast rates need to come down. Further soft German data series could further undermine the outlook for the EUR. EUR/USD may suffer from dips to 1.10 in the weeks ahead.

Further soft data may undermine the outlook for EUR

When it comes to deciding how quickly and how far interest rates should drop, policymakers are not in a “mad dash” to a neutral rate of interest. The German data series’ continued softness could further harm the EUR’s outlook. It’s possible that in the coming weeks, EUR/USD will decline to 1.10.

More dovish data could harm the EUR outlook.

The significance of this week’s German Sep IFO announcement is supported by the data released this morning. The outlook for the EUR could be further jeopardized by continued weakening in this series. Analysts still believe there is potential for declines to EUR/USD1.10 in the upcoming weeks.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations