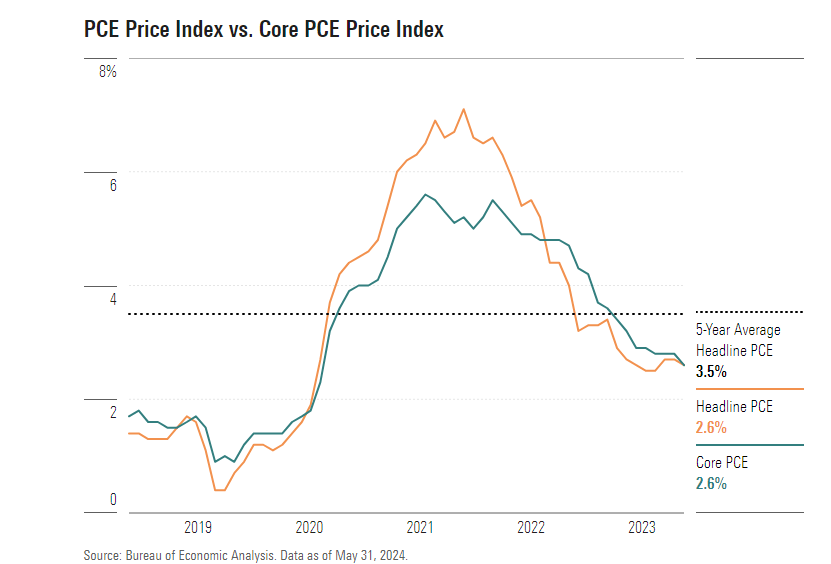

The economic landscape is shifting as evidence of cooling inflation becomes increasingly apparent. The June Personal Consumption Expenditures (PCE) Price Index report, a key metric closely watched by the Federal Reserve, is anticipated to reflect continued moderation in price growth. This positive trend, driven by factors such as declining gas prices and easing housing costs, is providing the central bank with greater flexibility in its monetary policy stance.

Economists are projecting a modest 0.08% increase in the overall PCE Price Index for June, following a flat reading in May. This deceleration in price growth is particularly encouraging given that the PCE is the Fed’s preferred inflation gauge. The core PCE, which excludes volatile food and energy components, is also expected to show signs of cooling, with a projected increase of 0.10%.

The convergence of these factors toward the Fed’s 2% inflation target is a significant development. Multiple months of subdued price pressures have instilled growing confidence that the central bank is successfully reigning in inflation. This progress is likely to influence the Fed’s decision-making process regarding interest rate adjustments.

A closer examination of the PCE components reveals a more nuanced picture. While the overall index is expected to show moderation, certain sectors, such as asset management fees, might exhibit temporary upticks. However, these increases are largely attributed to external factors rather than underlying inflationary pressures. Conversely, the decline in medical and hospital service prices is a positive sign, contributing to the overall disinflationary trend.

The housing market, a key driver of inflation in recent months, is showing signs of cooling. The deceleration in rental inflation, as reflected in both the Consumer Price Index (CPI) and PCE, is a welcome development. This trend, coupled with easing housing price pressures, suggests that the sticky inflation associated with the shelter component is finally beginning to abate.

The Fed’s response to this evolving economic landscape is crucial. While the central bank is expected to maintain interest rates at the upcoming July meeting, market expectations point to potential rate cuts later in the year. Bond futures indicate a high probability of a 0.25% rate reduction in September. This outlook is contingent on the continued moderation of inflation as reflected in the June PCE report and subsequent economic data.

The intersection of cooling inflation, a resilient economy, and the Fed’s policy stance creates a complex and dynamic environment. As policymakers navigate this landscape, the path forward will be influenced by a multitude of factors, including global economic conditions, geopolitical developments, and financial market volatility.

In conclusion, the recent trend of declining inflation is a positive development that strengthens the case for potential interest rate cuts. However, the Fed will continue to monitor economic indicators closely to assess the sustainability of this trend and to make informed decisions regarding monetary policy.

The ongoing moderation of inflation is a positive sign for the U.S. economy, but challenges and uncertainties persist. While the decline in energy prices has been a significant contributor to the overall cooling of inflation, the persistence of core inflation, which excludes volatile food and energy components, warrants close monitoring. The services sector, particularly housing and healthcare, continues to exhibit inflationary pressures, necessitating a nuanced approach to policymaking.

The Federal Reserve’s dual mandate of price stability and maximum employment presents a complex balancing act. As the central bank assesses the appropriate monetary policy stance, it must carefully weigh the risks of both persistent inflation and an economic slowdown. A premature tightening of monetary policy could stifle economic growth and job creation, while an overly accommodative stance could reignite inflationary pressures.

The global economic environment also plays a role in shaping domestic inflation trends. Factors such as supply chain disruptions, geopolitical tensions, and commodity price fluctuations can influence inflation expectations and the overall economic outlook. A coordinated global response to these challenges may be necessary to stabilize the global economy and mitigate inflationary risks.

In addition to the PCE, other economic indicators will be closely watched by policymakers and investors. These include employment data, consumer spending, and business investment. A robust labor market and healthy consumer spending can support economic growth while mitigating deflationary risks. However, excessive wage growth could put upward pressure on prices and complicate the Fed’s task of achieving its inflation target.

As the economy continues to evolve, policymakers and businesses must adapt to the changing landscape. A flexible and agile approach will be essential for navigating the challenges and opportunities presented by the evolving economic environment. By carefully monitoring economic indicators, understanding underlying trends, and implementing appropriate strategies, stakeholders can position themselves for success in a dynamic and uncertain world.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations