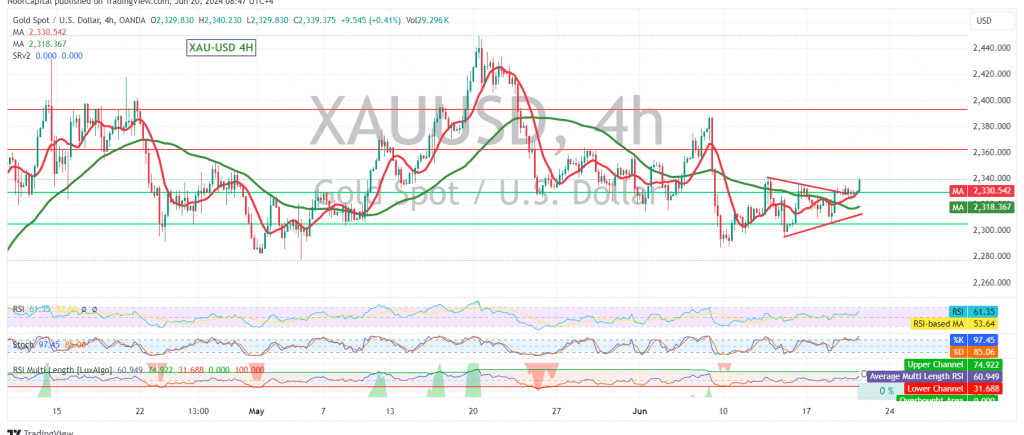

Gold prices opened on a positive note today, retesting the pivotal resistance level of 2340. However, the technical outlook remains predominantly bearish.

Technical Analysis

On the 240-minute chart, while the simple moving averages are now providing support from below, suggesting a potential upward trend, the price remains below the crucial 2340 resistance level. Additionally, the stochastic oscillator indicates overbought conditions, raising concerns about a potential reversal.

Bearish Outlook

As long as trading remains below 2340, we maintain a bearish bias. A break below 2324 could pave the way for further declines towards 2317 and 2310, with the ultimate target of the downward wave located at 2272.

Potential Reversal

However, traders should be aware that a successful penetration of the 2340 resistance level could invalidate the bearish scenario. In this case, gold prices may recover and shift towards an upward trend, potentially targeting 2349 and 2359.

Key Levels

- Resistance: 2340, 2349, 2359

- Support: 2327, 2324, 2317, 2310

Important Note

Today’s release of high-impact economic data, including the interest rate decision, monetary policy summary, and Monetary Policy Committee vote on interest rates from the British economy, as well as unemployment benefits data from the U.S. economy, could lead to significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations