Gold prices experienced positive momentum yesterday, approaching the significant resistance level of 2340 and reaching an intraday high of $2354.00 per ounce. However, the technical outlook presents a mixed picture, with both bullish and bearish signals vying for dominance.

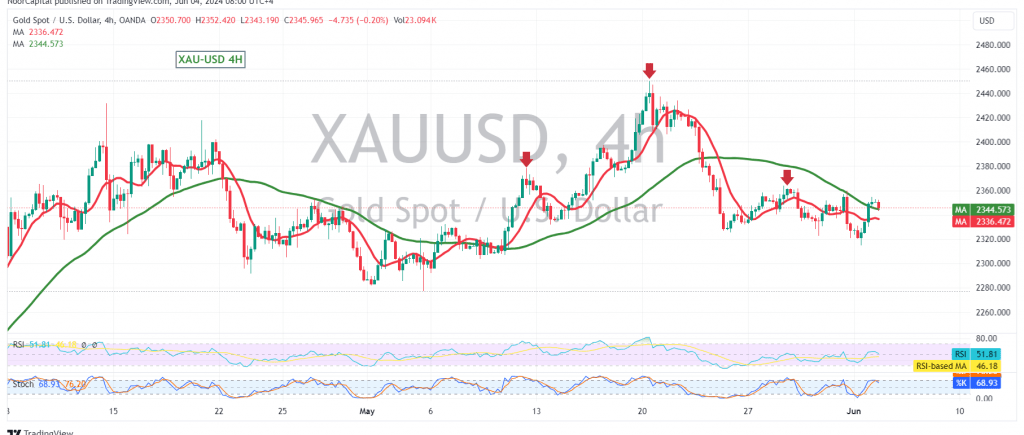

On the 4-hour timeframe chart, the 50-day simple moving average is still acting as a resistance, exerting downward pressure on the price. Additionally, the Stochastic oscillator is showing early signs of negativity, potentially indicating a weakening of the recent upward momentum.

While the price’s current stability above 2340 suggests a potential for further upside, a strong and decisive break above the main resistance at 2360 is necessary to confirm a bullish reversal. This breach would activate a bullish scenario, with subsequent targets at 2378 and 2400.

Conversely, failure to overcome the 2360 resistance level could lead to a continuation of the bearish correction. The bearish pattern on the chart, with its target at 2272, remains a significant downside risk.

Traders should exercise caution today as high-impact economic data releases from the U.S. economy, such as job vacancies and labor turnover rate figures, are expected. These announcements could trigger significant price volatility.

Moreover, ongoing geopolitical tensions continue to contribute to heightened volatility in the gold market. Investors are advised to closely monitor these developments and adjust their strategies accordingly to navigate the uncertain market conditions.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations