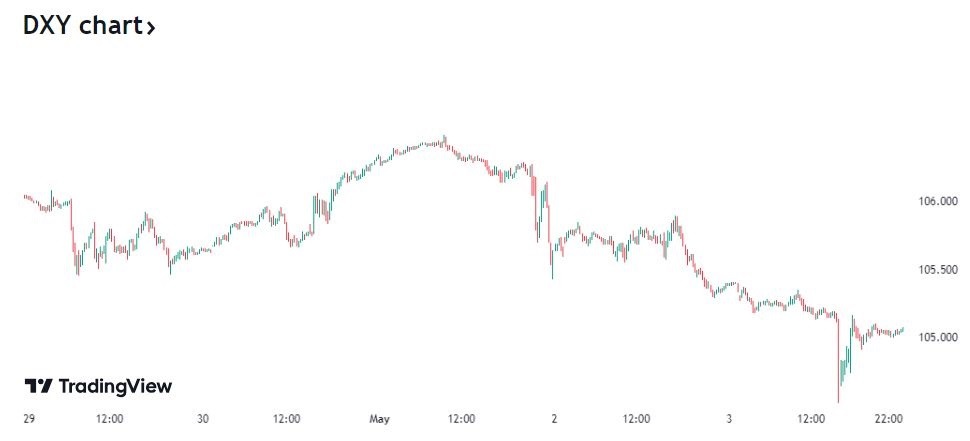

US Dollar Index (DXY) Slips on Weak Employment Data

Significant losses were incurred by the US Dollar Index (DXY), closing the North American session on Friday around the 105 mark, in contrast to the week’s opening reading of 106.093. This decline followed the release of US employment data for April, which fell short of expectations, exerting downward pressure on the dollar and bolstering gains in gold prices, US stocks, and risk assets.

US Treasury bond yields experienced declines across the board, with two-year bond yields dropping to 4.80%, while five-year and ten-year bond yields retreated to 4.50% and 4.58%, respectively.

US Nonfarm Payrolls Report

The US nonfarm payrolls report released on Friday revealed that only 175,000 jobs were added in April, falling short of the consensus expectation of 240,000 jobs and marking a decline from the revised employment growth of 315,000 in March. Concurrently, the unemployment rate climbed from 3.8% to 3.9%, accompanied by subdued inflation. Average hourly wages, however, showed a year-on-year increase to 3.9% from 4.1%.

Mere days after the Federal Reserve opted to maintain interest rates unchanged at its meeting ending on Wednesday, May 1, the US economy continues to present conflicting signals regarding the labour market, mainly concerning wage dynamics. This scenario reignites concerns about inflation, prompting Federal Reserve Chair Jerome Powell to adopt a cautious stance on the uncertain inflation trajectory. Powell underscored that the current tight monetary policy had mitigated the risk of economic overheating, yet weak labour market indicators have heightened the probability of an interest rate cut in September.

Interest rates persist within the range of 5.25% to 5.50%, a stance maintained by the Federal Reserve since July 2023, marking the highest levels in approximately 22 years. The Federal Open Market Committee (FOMC) voted in favour of decelerating the pace of asset sales, thereby signalling a gradual transition toward more accommodative monetary policy.

In rationalizing their decision on interest rates, the committee pointed to the halting of progress in further reducing inflation and its failure to consistently approach the official target of 2.00%.

The minutes from the latest meeting of the Bank of Japan’s Monetary Policy Council, disclosed on Thursday, indicate a consensus among policymakers that Japan is on the brink of reaching its 2% inflation target. They deem the prevailing conditions conducive to raising key interest rates, reflecting the sentiments expressed during the two-day meeting held on March 18 and 19. The minutes underscore Japan’s economy’s steady recovery at a moderate pace, a trajectory expected to persist despite lingering uncertainty surrounding economic activity and prices.

JPY: Bank of Japan’s Monetary Policy Council Meeting

The yen surged towards its most impressive weekly performance in over a year on Friday, buoyed by reports of government intervention aimed at preventing the Japanese currency from plummeting to its lowest levels in 34 years. This intervention exerted additional pressure on the US dollar, propelling the yen to achieve weekly gains of approximately 3.5%. This marks its highest performance since December 2022, with traders attentively monitoring potential fluctuations amid suspicions that Tokyo intervened to bolster its currency this week, with interventions estimated at up to 9.16 trillion yen ($59.8 billion), as per data from the Bank of Japan.

According to the Bank of Japan’s minutes, the current monetary policy remains apt given prevailing economic conditions and price dynamics, with continued purchases of Japanese treasury bonds to maintain their yield at 0%. It is noteworthy that during the aforementioned meeting, the Council resolved to hike interest rates for the first time in two decades, thereby becoming the latest major central bank globally to exit negative interest rates in light of indications of an upturn in the inflation rate. The bank increased the interest rate from -0.1% to +0.1%, marking a significant policy shift.

Oil Market Performance and Supply Dynamics

West Texas Intermediate crude witnessed a decline last week, sliding from $83.22 per barrel on Monday to $77.64 per barrel on Friday. Similarly, Brent crude followed suit, dropping from $87.45 per barrel on Monday to $82.52 per barrel on Friday. The fluctuating trajectory of black gold prices persisted, subject to both upward and downward pressures. A significant catalyst behind these fluctuations and the ensuing downturn in oil prices was the diminishing apprehension surrounding tensions in the Middle East. Positive signals regarding hostage negotiations and a ceasefire in the Gaza Strip alleviated concerns about oil supply disruptions, contributing to the recent decline in prevailing anxiety.

Last week’s oil market performance was influenced by the Energy Information Administration’s revelation that US commercial crude oil inventories surged by 7.3 million barrels to a total of 461 million barrels for the week ending April 26. This marks the highest inventory levels since June 2023, coupled with a notable decrease in the refinery utilization rate to 87.5%, down significantly from 90.7% during the same period last year.

The April 2024 drilling productivity report from the US Energy Information Administration revealed a notable upsurge in active drilling rigs compared to April 2023. Brazil and Guyana in South America contributed to this rise in supply. Additionally, Iran’s re-entry into the market further augmented the supply side, alongside recent declarations from Libya outlining plans to ramp up oil production to two million barrels per day.

Gold Prices and Market Sentiment

Gold prices retraced from earlier gains on Friday following the release of the US April employment report. Despite climbing to a daily peak of $2,310, the precious metal faltered in surpassing its May 2 high of $2,326. The XAU/USD gold index concluded around the $2,300 mark, registering a marginal decline ranging between 0.02% and 0.03%. The optimistic sentiment prevailing on Wall Street exerted pressure on gold’s status as a safe haven. Notably, US Treasury bond yields exhibited a downtrend, with benchmark 10-year bonds receding by seven basis points. Concurrently, US annual bond yields, which share an inverse relationship with gold prices, also experienced a decline of six and a half points, sliding from 2.219% to 2.146%.

European Stock Market Performance

European stocks kicked off Friday on a positive note, buoyed by robust earnings reports from French banks, including Société Générale and Credit Agricole, while the technology sector received a boost from Apple’s impressive performance and unprecedented share buyback program.

The European STOXX 600 index edged up by 0.2 percent, albeit on track for a weekly decline, with the banking index leading gains as one of the top performers among sectors.

Société Générale shares surged by 5.5 per cent following a smaller-than-expected dip in first-quarter net income, while Credit Agricole shares climbed by 3.7 per cent after posting a remarkable 55 per cent surge in first-quarter net profits, surpassing expectations. The French index mirrored these gains, advancing by 0.2 percent.

The technology index emerged as the standout performer, recording a 0.9 percent uptick, bolstered by Apple’s stellar results. Conversely, Glencore shares experienced a 1.8 percent decline amid reports of the mining company mulling over a takeover bid for Anglo American.

On Wall Street, the strength of tech behemoths is typically celebrated, with cautious optimism prevailing regarding the potential impact of Federal Reserve policies on stock performance. Nonetheless, companies grappling with adapting to shifting consumer preferences and an environment of economic uncertainty continue to face challenges. The trajectory of the broader US economy and its sustainability will inevitably shape the course of stock markets in the weeks ahead.

Bitcoin Performance and Market Reaction

After dipping below $57,000, Bitcoin surged to $63,215 following the release of the US nonfarm payrolls data, benefiting from a surge in risk appetite and a decline in the US dollar index. Consequently, Bitcoin, along with other risk assets, capitalized on the weakened dollar.

As market participants awaited the implications of the US jobs report, which maintained the unemployment rate below 4% for the twenty-seventh consecutive month, it’s noteworthy that since the Federal Reserve’s meeting on Wednesday, major Bitcoin sell-offs, orchestrated by entities known as whales, temporarily halted. These sizable sell-offs had previously rattled cryptocurrency markets for a significant period. The cessation of such operations facilitated a recovery in Bitcoin prices. Concurrently, discussions surrounding the halving event and its impact on the world’s most renowned cryptocurrency miners dwindled in prominence.

Upcoming Key Events

Investors and traders are eagerly anticipating several key events in the upcoming week, starting with the speech by Swiss Central Bank Governor Thomas Jordan on Monday, followed by the Australian interest rate decision on Tuesday. Later the same day, attention will shift to the release of retail sales data for the Eurozone, with consumer morale data scheduled for release on Friday. Additionally, market participants are closely monitoring statements from several Federal Reserve officials throughout the week, notably Tom Barkin, John Williams, Neel Kashkari, Deputy Governor Philip Jefferson, and concluding with remarks from Mary Daly and Michael Barr. Finally, on Friday, the monthly federal budget of the United States will be issued.

The battle against inflation remains a focal point, with investors eagerly awaiting statistics on loan availability and consumer confidence. These metrics, alongside unemployment, claims data, will offer deeper insights into labour market conditions and consumer response to price hikes amid a high-interest-rate environment. The state of the labor market remains a key determinant shaping the Federal Reserve’s monetary policy decisions. Consequently, future unemployment claims statistics will provide invaluable insights into employment trends and their potential impact on inflationary pressures.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations