Reports about missile attacks hitting Iran in the early hours of Friday prompted a flight for safety across financial markets. Financial markets immediately experienced risk aversion. US stock index futures were down between 0.55% and 0.8% in the early European session, reflecting the risk-averse environment in the market. The US Dollar Index, on the other hand, continued to remain largely stable above 106.00 following Thursday’s bullish ending.

Commodities:

The announcement quickly sparked a spike in the price of crude oil. WTI lost much of its gains after hitting a daily high of $85.58 during Asian trading hours. It was last seen increasing 1.6% on the day at $83.15. Following the news, gold surged beyond $2,410 but fell back to the $2,380 region early in the European morning. The yellow metal kept rising after comments by Fed’s Bostic and solid data that revealed US Initial Jobless Claims stayed constant from the prior reading.

Tough Week

The US markets witnessed a major pullback last trading week, especially in technology companies. The S&P 500 fell below the crucial 5,000 mark and had its worst weekly performance since March 2023. The post-earnings bounce from American Express helped the Dow Jones achieve a minor gain, but the tech-heavy Nasdaq saw its longest losing run in more than a year.

Sectoral Shifts:

This week saw a decline in technology companies, which had been leading the market’s recent surge. Chip stocks were under more pressure as investors seemed to be exiting the market. This development is consistent with worries about inflation and prospective adjustments to Federal Reserve policy. On the other hand, industries like house and car insurance proved resilient and had a good week’s end.

Earnings Season Woes:

This week’s earnings season continued with mixed outcomes. A key leader in the digital industry, Netflix, let investors down with a lower-than-expected revenue estimate for the full year and a change in its subscriber reporting policy. The announcement caused its shares to plunge. American Express, on the other hand, increased after announcing solid earnings. According to analysts, the US economy’s resilience, rising Treasury yields, and the current low valuations of banks could all be advantageous.

Geopolitical Impact:

Although they appeared to subside a little later in the week, the recent escalation of Middle East tensions in response to an Israeli strike on Iran contributed to market volatility. After a rise at the beginning of the week, oil prices ended with more moderate changes.

Beyond the Headlines:

Goldman Sachs’ Cautious Optimism: Despite the recent market downturn, Goldman Sachs maintains a modest positive outlook for equities over the next 12 months. However, they acknowledge increasing downside risks and a smaller potential upside compared to earlier predictions.

Emerging Market Debt Appeal:

While concerns regarding growth in emerging markets persist, their debt continues to be viewed more favourably than their equities.

US Dollar’s Performance

On the final trading day of the week, safe-haven flows rule the financial markets as investors flee from mounting concerns over escalating hostilities in the Middle East. There won’t be any important data releases on the economic calendar, and market players will be closely monitoring headlines related to geopolitics.

It is noteworthy that A notable feature throughout the first few months of 2024 was the consistently rising U.S. dollar, which contributed to the dollar’s strength against other major currencies. The euro, the single currency of Europe, is down 3.4% compared to the dollar as of mid-April.

Inflation-linked Concerns:

Concerns about inflation and possible Fed tightening were absorbed by the market, which made technology equities less popular. Risk was increased further by Middle East geopolitical tensions. Compared to other industries, the auto and house insurance sectors showed promise. The outcomes of the earnings season were uneven, with Netflix underwhelming and American Express doing well.

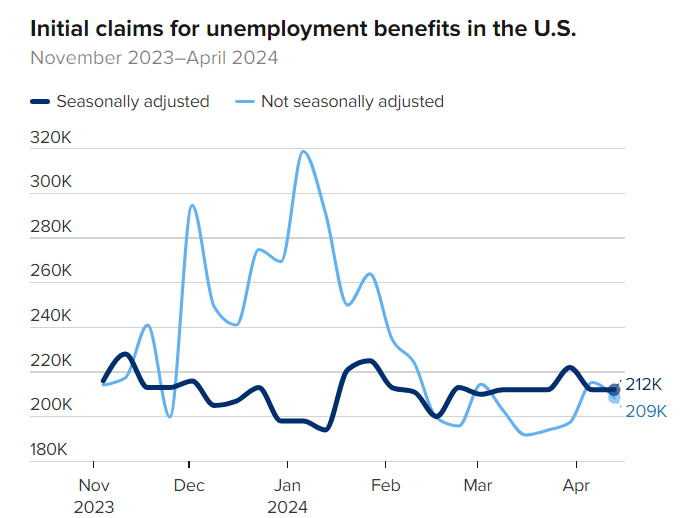

Fed’s Raphael Bostic stated that the US central bank still needs to do more to control inflation because it is now too high. The Fed won’t be able to lower rates, he continued. John Williams, the president of the New York Fed, had earlier said that the Fed is data-dependent and that monetary policy is sound, therefore he wasn’t in a rush to lower rates.

Bitcoin Halving

Bitcoin has reduced the incentives rewarded to miners for the fourth time in its history, marking the fourth time the event has been held. The Bitcoin halving, which occurs every four years, is designed to slow the issuance of bitcoins, creating a scarcity effect and allowing the cryptocurrency to maintain its digital gold-like quality. While some speculative trading may occur post-halving, the impact may be bigger months from now, even if bitcoin continues its trend of diminishing returns from its halving day to its cycle top. Two key factors to watch are the block reward and the hash rate.

The upcoming Bitcoin halving will create a supply shock as the previous ones had, but the concurrent demand shock created by the emergence of spot bitcoin ETFs could magnify the impact on the cryptocurrency’s price. The bigger immediate impact will be to the miners themselves, who run the machines that record new blocks of bitcoin transactions and add them to the global ledger, the blockchain. Miners with access to inexpensive, reliable power sources are well positioned to navigate the post-halving market dynamics.

Miners have two incentives to mine: transaction fees paid voluntarily by senders (for faster settlement) and mining rewards — 3.125 newly created bitcoins, or about $200,000 as of Friday evening. The reduction in the block rewards leads to a reduction in the supply of bitcoin by slowing the pace at which new coins are created, helping maintain the idea of bitcoin as digital gold. Eventually, the number of bitcoins in circulation will cap at 21 million, per the Bitcoin code.

Looking Ahead:

The key metric for assessing the state of the US economy is the consumer spending data that is awaited next week. Since a robust consumer base is essential for long-term economic growth, weak numbers may have an impact on investor decisions in the future. Despite the recent market drop and increased downside risks, analysts continue to have a cautiously bullish view on equities.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations