The US dollar heads into 2026 carrying visible scars from the past year. After a prolonged slide through 2025, the narrative around the greenback has shifted from effortless strength to cautious reassessment. This is not a collapse story. It is a stress test—one shaped by softer growth, narrowing policy advantages, and mounting structural pressures, countered by the dollar’s enduring role as the world’s ultimate financial fallback.

A Weaker Dollar Reflects a Cooling, Not Failing, Economy

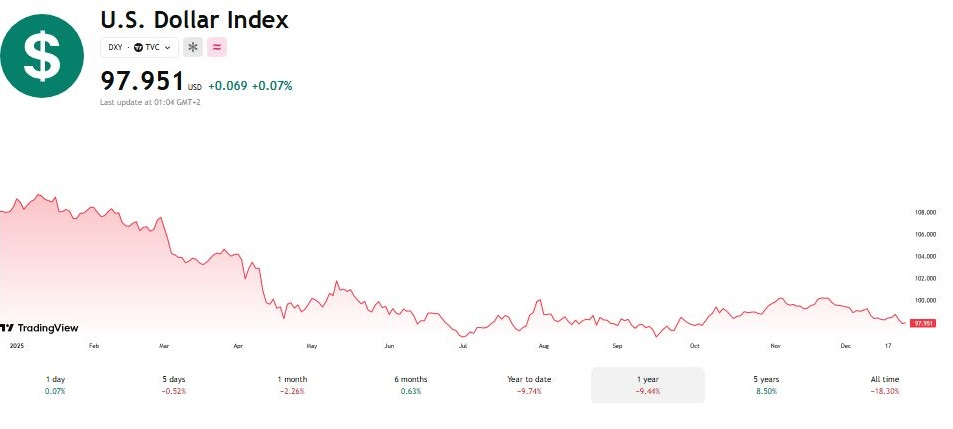

By late 2025, the US dollar index had slipped to just below 98, marking a year-to-date decline of nearly 10%. The move was not driven by crisis, but by normalization. US economic growth hovered around 2%, steady enough to avoid recession fears, yet insufficient to justify a strong-dollar premium.

Inflation dynamics played a decisive role. Price pressures eased from around 3% earlier in the year toward the low-2% range, allowing the Federal Reserve to guide interest rates lower toward the 3–3.25% range. As the yield gap between the US and other major economies narrowed, the dollar lost one of its most reliable sources of support. In this environment, currency performance became less about absolute strength and more about relative appeal.

Debt and Deficits Are No Longer a Background Concern

Cyclical weakness alone does not explain the dollar’s fading momentum. Structural concerns are increasingly part of the conversation. US public debt has climbed beyond $38 trillion, while annual fiscal deficits remain well above $1 trillion. These figures no longer sit quietly in the background; they shape how global capital evaluates long-term dollar exposure.

The issue is not reserve status erosion in the dramatic sense. The dollar remains central to global trade, finance, and reserves. The more subtle shift lies in confidence at the margin. Persistent borrowing needs imply heavier reliance on external financing, and over time, that dependence can translate into a higher tolerance for dollar weakness rather than reflexive demand.

Trade and Politics: Temporary Relief, Permanent Uncertainty

Trade policy offered brief relief late in 2025. Effective tariffs on Chinese imports were temporarily reduced to just under 30%, easing imported inflation pressures and helping stabilize costs for US consumers and businesses. The support for the dollar, however, proved modest and fragile. These arrangements are time-bound and politically sensitive, leaving markets wary of sudden reversals.

Source: TradingView

Domestic politics add another layer of volatility. Budget disputes and the recurring threat of government shutdowns inject uncertainty into economic planning and data reliability. While such episodes can undermine confidence in the short term, they also highlight a familiar paradox: during periods of global stress, capital often still gravitates toward the dollar, not away from it.

Why the Dollar Still Commands the Last Word

Despite mounting pressures, the dollar’s obituary has been written too many times before. Deep and liquid capital markets, legal certainty, and continued leadership in productivity-driven sectors—particularly artificial intelligence—remain powerful anchors for global investment. When geopolitical risks intensify, whether through energy shocks or regional conflicts, the dollar’s role as a safe harbor resurfaces quickly.

The most realistic outlook for 2026 is therefore uneven rather than directional. Early softness driven by easing monetary policy and fiscal unease may give way to periods of stabilization or recovery as growth holds up and global risks reassert the dollar’s defensive appeal.

For investors and traders, this landscape calls for discipline rather than conviction. Monitoring Federal Reserve decisions, fiscal negotiations in Washington, and geopolitical flashpoints will be critical. The defining question for 2026 is not whether the dollar weakens or rebounds—but how much pressure it can absorb before its long-standing credibility is truly tested.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations