The FOMC’s 25 basis point rate cut on September 17, setting the benchmark at 4.00%-4.25%, unleashed a market rally, but as the week of September 22-26 looms, a provocative question persists: with US labor markets faltering, private nonfarm payrolls averaging just 29,000 over three months, a recessionary signal, and inflation stuck at 3.3% year-over-year, does this “risk management” move, as Chair Jerome Powell called it, secure sustainable growth, or risk inflating asset bubbles amid tariff uncertainties and global political tremors?

Source: Federal Reserve Board

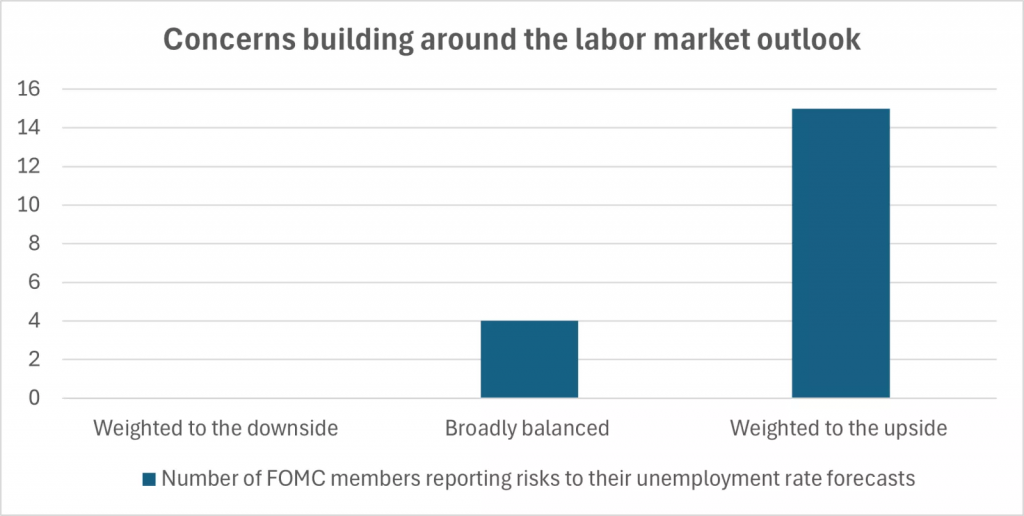

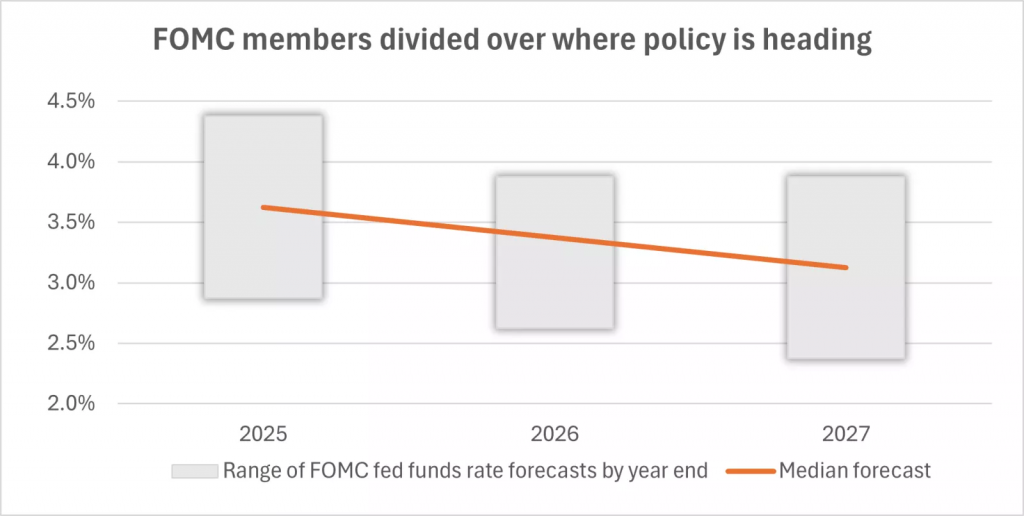

Powell’s data-driven, meeting-by-meeting stance, paired with FOMC projections of two more cuts this year, yet 40% of members anticipating none—signals ambiguity that could spark volatility. Historical easing cycles, like 2007’s, saw rallies unravel when structural flaws emerged.

Robust retail sales and a 3.3% Q3 GDP estimate from Atlanta Fed models fuel optimism, but job openings falling below the unemployed count for the first time in nearly a decade (excluding pandemic shocks) tilt risks toward higher unemployment.

Global policy splits—ECB holding at 2%, Bank of Japan at 0.5%—and trade frictions amplify concerns, suggesting the Fed’s cut may lift sentiment without tackling China’s slowdown or Europe’s stagnation. As markets pivot to key releases like Friday’s core PCE inflation data, the Fed’s preferred gauge, the week ahead will test whether this rally holds or fades into a mirage.

Euro and France’s Political Turmoil

France’s deepening political crisis, rooted in a fractured National Assembly post-Macron’s June snap elections, intensified as Prime Minister François Bayrou’s government collapsed on September 8 over a €44 billion austerity budget to address a €3.345 trillion debt (116% of GDP).

This second ouster in months—following Michel Barnier’s brief tenure—prompted Macron to appoint Sébastien Lecornu as interim prime minister on September 9, amid far-right National Rally leader Marine Le Pen’s calls for snap elections and France Unbowed’s impeachment push against Macron. “Block Everything” protests, with roadblocks and clashes on September 10 (nearly 500 arrests), and a September 18 trade union strike paralyzing rail and hospitals, reflect public fury over austerity seen as sparing the wealthy.

Far-right rallies on September 15, backed by figures like Elon Musk and Viktor Orban, protested Le Pen’s ineligibility conviction, while a leftist counter-rally drew 15,000. This chaos widened French-German bond spreads, spiked borrowing costs, and eroded trust, risking eurozone stability.

The euro (EUR/USD) ranged from 1.17287 to 1.17925, closing at 1.1744 on September 19—down 0.35% daily but up 0.08% weekly, 0.80% monthly, and 13.41% year-to-date. ECB President Christine Lagarde warned of France’s €67 billion debt servicing burden, with EUR/USD forecasts eyeing 1.19–1.25 by mid-2026 if reforms stall, pressuring ECB’s steady 2% rate.

US Stocks: Tech-Led Surge Masks Fragility

The S&P 500 rose 1.2% to 6,664, the Nasdaq climbed 2.2% to 22,631, and the Dow gained 1.0% to 46,315, hitting records driven by tech giants like Alphabet and Intel, buoyed by Trump’s TikTok deal easing US-China tensions. The Russell 2000’s 8.3% monthly surge to a 2021 peak reflects rate sensitivity, but uneven earnings—Lennar’s profit slump versus retail strength—expose tech reliance. FOMC’s split outlook risks volatility if upcoming PCE or PMIs disappoint, challenging broad recovery hopes.

Source: Federal Reserve Bank Board

Global Stocks: Cautious Gains Amid Policy Splits

The MSCI World index gained 1.1%, but the MSCI EAFE stayed flat weekly despite a 22.0% year-to-date rise. Europe’s STOXX 600 faltered under trade fears and ECB’s steady rates, contrasting Fed easing. Policy divergences and tariff risks could derail global equity momentum, countering bullish narratives.

Asian Stocks: Leaning on US Cues

The MSCI Asia-Pacific rose 0.7%, with Japan’s Nikkei up 1.0% and Hong Kong’s Hang Seng adding 0.8%, lifted by Fed cuts and TikTok progress. China’s weak demand and a flat ASX 200 underscore reliance on US sentiment, not local strength, questioning uniform optimism.

Gold and Silver: Safe Havens Thrive

Gold rallied 1.5% to $3,685 per ounce (up 40.38% year-to-date), hitting new highs as a hedge, while silver surged 3.03% to $43.09 (from $41.82225), driven by industrial demand and Fed-driven flows. These gains reflect safe-haven demand amid uncertainty, not just rate-cut exuberance.

Crude Oil: Supply Glut Caps Upside

WTI crude fell 1.36% to $62.40 per barrel (down 13.15% year-to-date), and Brent crude dropped 1.27% to $66.65 (down 13.1% year-to-date), pressured by global oversupply (105 million barrels daily, US at 22 million) and weak Chinese demand. Middle East tensions, including Israel’s strikes, added volatility but failed to lift prices, with Brent’s close signaling demand concerns dominate.

Cryptocurrencies: Risk-On Surge

Bitcoin rose 2.5% to $116,057, and Ethereum gained 1.8%, riding post-Fed risk-on sentiment. Bitcoin’s $185,000 forecast reflects optimism, but volatility underscores reliance on market confidence, not fundamentals.

Treasury Yields: Cautious Uptick

The 10-year Treasury yield rose 0.1% to 4.13%, within a 4%-4.5% range, reflecting FOMC’s hawkish dot plot and steady jobs data. Bonds (iShares Core US Aggregate Bond ETF) dipped 0.2% weekly but held a 6.2% year-to-date gain, signaling limited upside amid fiscal pressures.

Currencies: Dollar’s Mixed Signals

The USD index rose 0.29% to 97.68 (down 10.03% year-to-date), slipping 0.3% overall—flat at 1.1744 versus the euro, up 0.3% to 1.35 against sterling, firming to 147 on the yen, and steady at 1.38 on the Canadian dollar. Policy fragmentation (BoE at 4%, BoJ at 0.5%) risks forex swings.

Central Bank Policies: Delicate Balance

The Fed’s near-unanimous cut, despite Stephen Miran’s 50 basis point dissent, targets labor weakness but risks tariff-driven inflation. ECB, BoE, and BoJ’s steady rates signal global caution, potentially capping Fed-driven optimism if inflation spikes.

Corporate Earnings: Sectoral Divide

Lennar’s profit declines highlight high-rate pressures, while retail sales beats and FedEx’s awaited results suggest consumer resilience. Housing’s weakness versus broader strength questions uniform sector recovery.

Political Unrest: Underlying Volatility

The TikTok deal eased trade fears in the Sino-American context, but Middle East tensions, Ethiopia clashes, and Lebanon protests added volatility to oil and forex. Without escalation, impacts remained muted, but risks linger.

The Week Ahead: PCE and PMIs in Focus

Friday’s core PCE Price Index, expected at 0.2% month-over-month and 2.7% year-over-year, headlines, with any upside surprise potentially echoing 2022’s hawkish shift, challenging the 90% odds for October/December cuts. Tuesday’s S&P Global Flash PMIs (US Manufacturing at 47.5, Services at 55.2) test tariff-driven factory upticks, while Germany’s PMI (41.0 expected) probes export weakness. Wednesday’s Existing Home Sales (3.95 million units) and Thursday’s Durable Goods Orders (+0.1%) gauge consumer strength, with revised Q2 GDP (3.0%) refining outlooks.

France’s unrest could drag eurozone PMIs (Composite at 51.5), testing EUR/USD’s resilience. Earnings from AutoZone ($40.48 EPS), FedEx ($5.36 EPS), General Mills ($1.06 EPS), and Nike ($0.47 EPS) will probe sectoral health, with tariff exposure and consumer trends key.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations